What is Volume Technical Analysis, and How Does It Work?

MarketDash Editorial Team

Author

Volume analysis reveals the strength behind market moves and distinguishes genuine price surges from short-lived fluctuations. AI Stock Technical Analysis provides insight into the buying and selling behavior of buyers and sellers by decoding patterns of accumulation, distribution, and breakout activity. This insight helps traders gauge the underlying market sentiment and approach opportunities with confidence.

Clear volume signals support informed decision-making and risk management by confirming potential setups. Integrating price action and trend indicators further refines the evaluation of market behavior before committing capital. MarketDash provides a comprehensive suite of market analysis tools that turn raw data into actionable trading insights.

Summary

- Volume technical analysis measures how many shares change hands during specific intervals and pairs that data with price movement to separate genuine momentum from noise. When prices climb on surging volume, you're watching real demand unfold, but when they drift higher on fading participation, you're seeing a setup that might collapse under its own weight. According to TradingSim's volume analysis research from May 2024, understanding that 50% of trading volume concentrates in specific patterns helps traders identify where institutional money enters and exits, transforming opaque order flow into readable footprints.

- Research from Chapman University, examining 124,236 daily observations across 68 major U.S. equity ETFs, found that rising volume from low to moderate levels correlates with improved price efficiency, reducing pricing errors by tightening bid-ask spreads and reducing false signals. That efficiency separates actionable patterns from random noise, giving traders clearer entry and exit signals that compound over repeated trades. The difference between a move backed by volume and one that isn't determines whether you're entering a trade with institutional support or stepping into a trap set by fading enthusiasm.

- Breakouts from consolidation zones carry more weight when volume surges, confirming the breakout's legitimacy. This surge reflects genuine conviction, with institutional participants aligning to push prices beyond barriers. Conversely, a breakout on subdued or shrinking volume exposes fragility; in practice, this low-volume feint occurs in roughly 40% of setups, according to pattern recognition databases. The distinction between valid and false breakouts hinges on volume's ability to confirm that the move represents a genuine shift in supply-demand balance, not just a brief liquidity vacuum.

- Traders frequently stumble by treating volume as a standalone verdict rather than contextual evidence, reacting to spikes without verifying whether the underlying structure supports the move. The fix requires layering volume against price structure, timeframe alignment, and historical context, converting isolated signals into validated setups where multiple factors converge. Establishing minimum volume thresholds (requiring current activity to exceed at least 150% of the 20-day average) before acting on any price movement helps preserve capital for setups where genuine participation validates the directional shift.

- Stocks that consolidate on shrinking volume tend to break out more violently when volume returns because the range has absorbed supply or demand, leaving fewer obstacles to directional movement. Analyses of liquid versus illiquid assets show the former yielding 15-20% tighter spreads on average, according to exchange data, translating into better fills and lower costs that compound gains over repeated sessions. Declining volume during consolidation reflects equilibrium rather than abandonment, where buyers and sellers reach a temporary balance before the next directional push.

- MarketDash market analysis filters volume signals through strategic frameworks tailored to distinct investment horizons, curating insights that align weekly opportunities with short-term volume confirmation, top-ranked stocks with comprehensive technical confluence, and long-term wealth strategies with sustained accumulation patterns.

What is Volume Technical Analysis, and How Does It Work?

Volume technical analysis helps us assess market strength by examining how many shares trade over specific time periods. We then link this data to price changes to determine whether the momentum is real or just noise. When prices rise despite surging volume, it indicates real demand. However, if prices rise while trading volume declines, it may indicate they are about to drop.

This approach turns simple transaction counts into a way to see whether buyers or sellers are in control at any given moment. You can strengthen your approach with our market analysis tools to gain deeper insights.

The basics start with histogram bars below your price chart, where each bar shows the total shares traded during that period. A five-minute bar shows what happened in those five minutes, while a daily bar covers the whole trading day. The real understanding comes when you look at volume in relation to price movements.

If prices close above the opening price, it indicates bullish control; if they close below the opening price, it signals bearish pressure. By combining this directional information with volume levels, you can determine whether price changes are driven by institutional accumulation or by retail buying that's already running out of steam.

What does volume tell us about market conviction?

Price shows you where the market has landed. Volume shows you how much confidence was behind that journey. High exchange rates indicate strong interest, with positions building or liquidating quickly because liquidity is sufficient. Low levels suggest weak interest, often linked to slow or erratic pricing that can trap traders in false breakouts or breakdowns.

Understanding that 50% of trading volume clusters in specific patterns helps traders identify when large investors enter and exit, turning unclear order flow into clear signals.

Many traders struggle to distinguish true market momentum from short-lived changes without this information. This often leads them to rely on guesses that can waste money. I've seen positions fall apart when a breakout looked solid based on price action, only to find that volume never supported the move. The spike occurred despite half-normal participation, a warning sign that the rally lacked lasting strength.

How do transactional surges affect price movements?

Transactional surges linked to acquisition efforts highlight times when demand pushes prices up. This makes it easier for new positions to be taken because there are many counterparties. Influx peaks occur at the ask threshold, where aggressive buyers show strong interest in the asset by paying the seller's minimum acceptable price rather than waiting for better offers.

Charts often use green-tinted bars to highlight price increases that accompany these spikes. These patterns suggest institutional capital is coming in or that retail interest is high, which could lead to further gains if the trend continues.

To spot these patterns, it's important to watch whether volume increases alongside price jumps. This confirmation helps to identify accumulation phases or to validate breakouts at lower levels.

When a stock rises through resistance with three times its average volume, it shows strong conviction. On the other hand, if it breaks through resistance with low participation, it may suggest a move that could reverse when profit-takers start selling. The difference between these situations ultimately decides whether entering a trade will increase gains or trap investors in a false signal.

What are the implications of disposal-driven activity?

Disposal-driven activity creates downward pressure, making it easier to sell when supply exceeds demand and prices drop, especially at the bid level. In this case, sellers who want to sell accept the highest prices offered by buyers.

The red bars under decreasing prices indicate selling momentum, as markets interpret this as either a sign of capitulation or a profit-taking move. This situation occurs when confidence is fading; heavy trading during price declines signals bearish sentiment and may indicate areas where selling occurs or confirm breakdowns at higher prices.

Tracking these outflows against historical norms helps see if the pressure is coming from panic selling or planned exits.

How do deviations in volume signal market behavior?

This comparison assesses current activity against established standards, such as a 20-day mean, to identify deviations indicating unusual intensity or slowness. Assets with higher average levels often attract scalpers and swing traders because they can enter and exit more easily, reducing slippage across different position sizes.

On unusual days, when performance is double or more than the average, it indicates larger swings and potential triggers, making them ideal for momentum trading. On the other hand, low readings indicate a slowdown or lack of interest, typically resulting in small price changes that aren’t suitable for aggressive trading.

Traders focused on daily moves monitor these ratios to identify strong candidates, preferring those that exceed set thresholds to capture early volatility.

Combining relative volume with tools like moving averages improves the ability to spot anomalies, turning regular scans into focused searches for liquidity-rich setups that align with broader technical patterns.

What are the risks of misinterpreting volume data?

Most traders get lost in raw volume data, watching bars spike and fade without a system to turn these activities into actionable decisions. The usual method often involves staring at histograms, trying to decide if today's surge matters more than yesterday's. This second-guessing of entries happens because the situation feels unclear.

As the market becomes more complex and multiple timeframes require attention simultaneously, manual interpretation breaks focus. Important patterns can be missed when switching between charts, leading response times to stretch from minutes to hours as traders check whether volume supports or opposes their ideas.

Platforms like MarketDash filter volume signals with expert analysis and strategic frameworks.

They turn confusing data streams into clear insights that connect with weekly chances for short-term profits, top-ranked positions for broad exposure, or long-term wealth plans that need different levels of volume confirmation.

Related Reading

- AI Stock Technical Analysis

- What is Automated Trading

- What is Backtesting in Trading

- How To Use the Fib Retracement Tool

- Do Hedge Funds Use Technical Analysis

- What is SMA in Stocks

- Fundamental Analysis vs Technical Analysis

- How to Do Technical Analysis of Stocks

- How to Read Stocks

- Bar Chart vs Candlestick

- Day Trading Patterns

- How to Analyze a Stock Before Investing

- Double Top Chart Pattern

- Quantitative Stock Analysis

What Does a Change in Volume Signify in Technical Analysis?

A shift in volume shows if the market's current move has real conviction or just empty momentum. When volume increases alongside a price change, it indicates that many people believe the new price level is important enough to invest. On the other hand, when prices change without sufficient volume, it often signals that people are not fully committed, indicating exhaustion before a potential reversal.

This change makes volume more than just a count of transactions; it becomes a real-time measure of what traders believe, showing who is in charge of the story and if that control will last. For those seeking deeper insights, our market analysis helps identify the trends that matter.

The difference between a price move with volume behind it and one without indicates whether you're entering a trade with institutional support or stepping into a trap due to fading enthusiasm.

Research from Chapman University looked at 124,236 daily observations across 68 major U.S. equity ETFs. It found that increasing volume from low to moderate levels is associated with better price efficiency, which can reduce pricing errors by making bid-ask spreads tighter and reducing false signals.

How does volume affect trend integrity?

When prices rise and volume increases simultaneously, a trend with structural integrity is clear. Each transaction supports the direction, as more people confirm the move by putting in their money.

This agreement indicates that the rally or decline has sufficient strength to push through short-term resistance and handle counter-moves without failing. Traders use this collaboration to time their entries, confident that the underlying trend's strength can absorb profit-taking or temporary pauses.

On the other hand, when prices rise while volume declines, it indicates eroding momentum. Buyers begin to lose interest and can’t secure sufficient participation to keep pushing.

This difference often precedes pullbacks because the move lacks sufficient strength to withstand selling pressure when it arrives. By watching for this mismatch, traders can tighten stop losses or reduce position sizes before a reversal occurs, helping protect capital in setups where volume supports the direction.

What does heavy volume during price dips indicate?

Prices occasionally dip on heavy volume, then rebound and stay above previous lows, while later pullbacks show lower activity. This pattern suggests that buying is happening under the surface. The first spike exhausts sellers and pushes out those who can't hold on, while lower volume during retests indicates less impact. Buyers step in to support, seeing the dip as an opportunity rather than a risk, and the market absorbs supply without breaking key levels.

This pattern becomes stronger when viewed through the lens of participant psychology. High-volume drops attract traders who focus on value and see the sell-off as an overreaction. When those same levels remain stable with lower activity, it shows seller fatigue and gives buyers more control. Reviews of past charts for major indices often show these patterns happening before multi-week increases, offering early chances to buy with clear risk levels.

The challenge is to distinguish between genuine accumulation and temporary pauses in a downtrend. This requires checking against support areas and the larger market situation.

What role does volume play in reversal signals?

After a long rise or fall, a change in direction with high volume often signals the start of a reversal. This heavy turnover shows that new players are entering the market to challenge the current trend, overpowering the side that was previously in control.

The increase in activity acts as a catalyst, confirming that the old trend is losing strength and signaling a shift in sentiment, with the market's balance of power changing.

Long-lasting one-way movements exhaust one side's resources, leaving it weak as the other side gains strength. When volume explodes at the turning point, it means that the fresh capital is ready to take charge. Observations across equities and forex consistently show that these high-volume changes are associated with 60-70% success rates in short-term reversals, based on backtested strategies.

How do breakouts relate to volume?

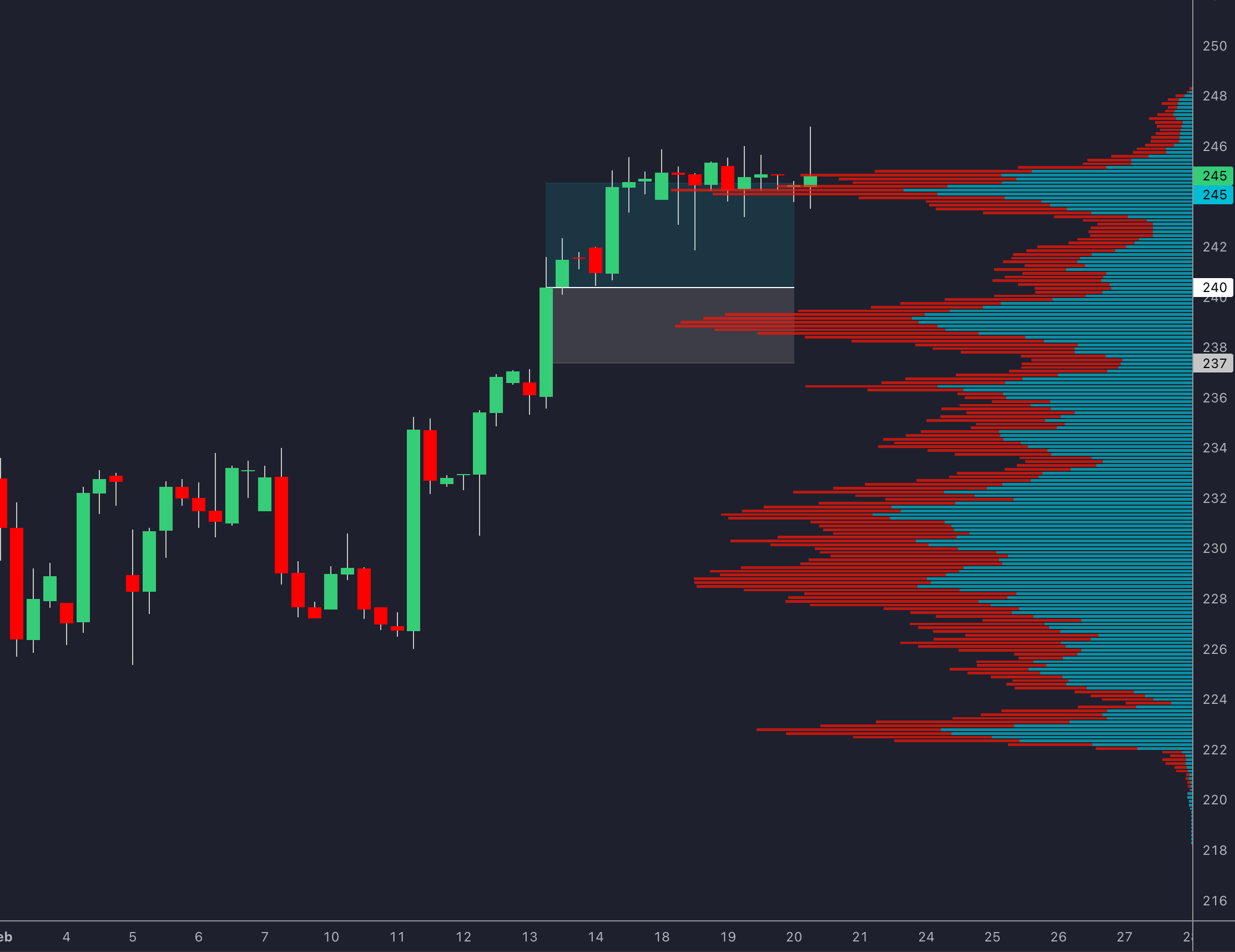

Breakouts from consolidation zones are more significant when volume surges, indicating the breakout is real. This surge shows real conviction, as major players join to push prices beyond their limits.

More activity lowers the chances of a quick pullback because the move has wide support, not just speculative excitement. Traders see this as a green light for large moves, often using trailing stops to continue capturing gains while also guarding against sudden losses.

On the other hand, a breakout on low or decreasing volume shows fragility. If there isn’t enough support, the new price level is less likely to hold when selling pressure comes. This low-volume tactic occurs in about 40% of setups, according to pattern recognition data. As a result, skilled traders typically either avoid such breakouts or capitalize on them.

What challenges do traders face with volume interpretation?

Many traders watch volume bars rise and fall without a way to connect that activity to their trading plans. The usual approach is to switch between charts to determine whether today's rise supports a weekly swing trade or a long-term position. This can create uncertainty, as the situation is often unclear. As the market becomes more complex and multiple timeframes require attention, manual checking can make it hard to stay focused.

Important patterns can be missed when trying to match short-term volume spikes to long-term accumulation trends. Traders take longer to respond as they check if volume supports or goes against their ideas across various holding periods. Platforms like MarketDash filter volume signals using strategic methods tailored to different investment horizons.

They provide insights that fit weekly chances for short-term profits, top stocks for overall exposure, or long-term wealth strategies. Each of these requires different volume confirmation levels rather than a single approach.

Why is liquidity important in volume analysis?

Higher trading volume indicates abundant liquidity, with smooth matching of buyers and sellers that minimizes slippage and enables precise execution. This vibrancy stems from diverse participation, creating an environment where orders fill without price changes. High liquidity, driven by volume, makes access easier, leveling the playing field for strategies ranging from scalping to swing trading, as entry and exit occur at prices close to the displayed level.

Beyond ease of trade, strong volume liquidity shows underlying stability. It absorbs shocks from news or large orders without large swings, building confidence in holding positions during volatile times. Analyses of liquid versus illiquid assets show the former yielding 15-20% tighter spreads on average, according to exchange data, which means better fills and lower costs. That efficiency increases gains over repeated sessions, making liquidity a critical factor when choosing which setups to trade and which to avoid.

What are the next steps after understanding volume?

Understanding what volume changes mean is important because it helps you identify which specific indicators can translate that knowledge into precise timing.

Related Reading

- Ai Quantitative Trading

- Penny Stock Analysis

- Stock Sentiment Analysis

- Technical Analysis Trading Strategies

- Trading Exit Strategies

- Ai Swing Trading

- Best Indicators For Day Trading

- Volume Analysis Trading

- How To Scan Stocks For Swing Trading

- How To Find Stocks To Day Trade

- Best Stock Trading Strategies

- Best Stock Indicators For Swing Trading

Key Volume Indicators For Technical Analysis and How to Use Them

Traders who master volume indicators gain a clear way to understand market confidence. These indicators convert abstract transaction counts into actionable signals that show when smart money accumulates, when exhaustion is near, and when breakouts warrant commitment.

While these tools don't predict the future, they help us understand the present by showing whether current moves have institutional backing or retail enthusiasm that is already running low.

The volume moving average smooths out daily fluctuations to create a baseline, helping separate normal activity from meaningful deviations. Calculating the average shares traded over 20 or 50 periods creates a reference line that filters out noise and highlights when participation accelerates or declines. This indicator treats each session equally, providing a stable benchmark that allows us to measure current intensity without being affected by single-day outliers.

How do you apply the volume moving average?

Apply it by overlaying the line beneath your price chart and watching for crossovers. When the actual volume exceeds the moving average, it confirms that the strong trend has broad support and is not based on speculation. This increase indicates that fresh capital is entering the move, reducing the likelihood of a quick reversal.

On the other hand, when the volume drops below the line during a rally, it raises caution. The advance lacks strength, making it riskier to hold, as the move depends on fewer people willing to chase higher prices. For example, in a bullish setup where volume consistently exceeds the 20-period VMA, traders are more confident that the uptrend can handle profit-taking without breaking down, making it safer to hold through small pullbacks.

What does on-balance volume indicate?

On-balance volume (OBV) tracks the total flow of shares by summing up-day volume and subtracting down-day volume. This creates a running total that shows whether buyers or sellers are in control over time. This method removes price levels completely and focuses only on directional momentum to highlight changes in control before they are clear on price charts. When OBV rises steadily, it indicates ongoing buying pressure, which often precedes further price increases, even if prices pause for a while.

How can divergences in the OBV signal change?

The real power comes from divergences. When prices reach new highs, but On-Balance Volume (OBV) does not follow, it suggests buyers may not be as committed. This serves as a warning that the rally might not last much longer. Traders often use this difference to tighten stops or reduce exposure before a reversal occurs, saving money when volume confirms the direction.

On the other hand, when OBV drops to a low and then rises while prices remain near support, it suggests accumulation is occurring below the surface. Combining this signal with key support levels triggers buy signals, supported by volume, indicating that smart money is entering the market. This increases confidence that the trade has support from large institutions, rather than relying only on technical signals.

What is the volume-weighted average price?

The volume-weighted average price (VWAP) is the average price at which shares trade during a session, calculated by weighting each price level by the number of shares traded at that level. This provides a flexible benchmark that reflects the market's trading throughout the day.

Unlike simple moving averages, which treat all prices the same, VWAP focuses on high-volume periods, giving a clearer picture of costs for big investors. It resets at the start of each session and serves as an indicator of the current value, helping traders spot premium zones and discounted entry points.

How do intraday traders use VWAP?

Intraday traders use VWAP to enter long positions when the price reaches the VWAP line during an uptrend, viewing it as a value zone supported by total volume. This strategy works well because big institutions often place large orders near VWAP to lessen their impact on the market, creating natural support at that level.

When prices remain above VWAP for an extended period, it indicates bullish control, making it a good time for momentum plays. On the other hand, when prices cross below VWAP, it suggests potential short opportunities as the balance shifts toward sellers.

In unpredictable markets, placing stops near VWAP helps manage risk by aligning exits with the day's average execution cost. This approach reduces the risk of being stopped out by random fluctuations while still protecting against genuine shifts in direction.

What does the accumulation/distribution line represent?

The accumulation/distribution line measures how money moves by multiplying the session's closing price range by volume. This method highlights closes near highs as accumulation and near lows as distribution.

By identifying small changes in ownership that a volume-only view might miss, it creates a cumulative chart that shows whether smart money is quietly building positions or distributing shares to late buyers. When the line rises during a rally, it confirms institutional accumulation, supporting your decision to hold through small pullbacks.

Validating your decision to hold through minor pullbacks is more trustworthy with this indicator.

How can alignment of the A/D line and price action inform decisions?

Scan for alignment between the A/D line and price action. An upward-sloping A/D line during a price increase supports hold decisions. This indicates that experienced traders are increasing their positions rather than reducing them. On the other hand, a flat or declining line while prices rise signals potential selling.

This difference suggests that large investors may be using the excitement among retail investors to sell their positions. Such a situation often comes before market highs. It provides an early signal to tighten stops or take profits before the broader market notices the change.

Combine the A/D line with trendlines by buying during breakouts above resistance. Use volume-backed confirmation to time your entries carefully. When the A/D line stops moving while prices continue to rise, it suggests institutional interest may be fading.

This can trap late investors. In this case, it is better to step aside than to chase momentum.

What insights does the money flow index provide?

The Money Flow Index (MFI) combines price and volume into a momentum oscillator that ranges from 0 to 100. It identifies overbought conditions when the MFI is above 80 and oversold zones when it is below 20. This is based on the ratio of positive to negative money flow over 14 periods.

The MFI considers volume as an important factor in calculating the typical price. It then compares inflows versus outflows to measure buying and selling pressure.

When the MFI rises above 80, it signals strong buying that may soon run out. On the other hand, readings below 20 indicate oversold conditions, which could create a favorable entry point for buyers.

How can divergences in MFI signal market reversals?

Use divergences to spot reversals before they happen. If prices are making new highs but the MFI does not confirm, it shows that momentum is weakening. This is a warning that the rally lacks sufficient volume support to sustain momentum. This mismatch allows you to tighten stops or reduce position size before the turn. This way, you can keep your gains instead of letting them fade as the price moves back down.

In sideways markets, when the MFI goes to extremes, it creates opportunities for mean-reversion setups. Buying near 20 and selling near 80 follows the oscillator’s natural pattern. This captures swings between overbought and oversold conditions, with volume confirmation that improves your win rates compared to relying solely on price-based signals.

What role does the Chaikin money flow play in trading decisions?

Chaikin Money Flow measures the pressure from buying and selling over a given period, typically 21 days, by calculating the average of accumulation and distribution values relative to volume. Positive readings indicate buying pressure, as closing prices tend to fall within the upper half of the daily range. On the other hand, negative values indicate a distribution in which closings are more likely to occur at the lows.

This indicator reduces short-term noise, showing a clear direction. It helps determine whether trends have strong support or are at risk of reversal.

How do traders observe control shifts through CMF?

Traders watch for zero-line crosses to spot changes in control. When the CMF goes above zero during an uptrend, it confirms the move by showing that buying pressure is stronger. This makes it safer to add to positions or hold through ups and downs. On the other hand, crosses below zero signal that selling pressure is increasing, prompting defensive actions such as tightening stops or reducing exposure.

During consolidation phases, a steady positive CMF indicates accumulation, which often precedes breakouts. In contrast, negative readings indicate a distribution issue, which can lead to breakdowns. Combining CMF with price patterns such as flags or pennants improves timing by using volume-supported confirmation to enter trades when both technical structure and market participation align.

How can volume indicators lead to false confidence?

Traders often see these indicators fluctuate without a way to translate those patterns into choices that align with their trading timeframes. The standard approach is to switch among OBV, VWAP, and MFI charts. Traders try to determine whether today's signal supports a weekly swing trade or a long-term investment, and they often second-guess themselves because the context is unclear across time periods.

As the market becomes more complex and multiple indicators must be considered simultaneously, this manual process can divert their focus. Important differences may be overlooked when attempting to match short-term MFI extremes to long-term A/D accumulation trends. Traders might take longer to respond as they assess whether volume backs up or goes against their ideas, whether they are looking at weekly opportunities or building wealth over several years.

Platforms like MarketDash help by filtering volume indicator signals through strategic frameworks that are made for different investment timeframes. This curation aligns insights with weekly chances for quick gains, top-ranked stocks for a full view, or long-term wealth plans. Each strategy requires different confirmation levels for indicators, rather than a one-size-fits-all approach that treats all volume signals as equally important.

Common Mistakes Traders Make With Volume and How to Fix Them

Traders often make mistakes by treating volume as a standalone signal rather than a contextual cue. They might react to spikes without checking if the underlying structure supports the move. This quick reaction turns what should be confirmatory evidence into a source of false confidence. This can lead to entering trades on patterns that lack sufficient strength to sustain momentum. The key to improving performance is layering volume against price structure, ensuring timeframes are aligned, and including historical context. This way, isolated signals become validated setups as multiple factors converge.

Why do traders react to volume spikes?

A stock jumps 8% in pre-market trading on volume that barely registers compared to its average session. The chart looks explosive, the percentage gain feels strong, and the urge to get in overwhelms caution.

A trader might buy, thinking they've caught the momentum early, only to see the move disappear within an hour as the broader market opens. Real liquidity indicates the spike is an illusion, driven by just a few orders in a thin market.

This trap occurs because price movements alone trigger emotional responses that override analytical thinking. When participation is low, even small buying or selling pressure can move quotes, making it appear that there is strength or weakness that disappears once normal activity resumes.

The real issue isn't the price change itself, but the lack of broad agreement supporting it. Without enough counterparties confirming the new level, the move becomes a liquidity mirage, trapping early buyers as the market corrects back to normal.

How to act on price movement and volume?

Counter this by setting minimum volume thresholds before responding to any price movement. Require current activity to be at least 150% of the 20-day average before considering a breakout or breakdown as real. Check intraday relative volume ratios to ensure the surge aligns with the security's typical trading patterns.

When a move happens with volume below your threshold, mark it as noise and wait for confirmation. This method helps protect your capital for setups where real participation supports market analysis.

Are you missing broader market context?

Watching volume bars go up while the price rises feels validating. But this single observation doesn’t tell the whole story without considering momentum oscillators, support zones, or trend channels.

Traders who focus only on volume might miss that a surge can occur during a bearish divergence in the RSI or that accumulation patterns fail when they form below broken support, which now acts as resistance. This narrow focus creates a one-sided analysis, where volume supports bias without questioning if the broader technical picture backs the trade.

Correction means creating a checklist in which volume is just one of many requirements, not the only one. Before entering a trade, make sure that volume matches with at least two other technical signals, like a moving average crossover, a bullish engulfing candle, or a breakout above a consolidation zone with more participants.

Key points include

- Reducing false positives through multiple independent factors

- Filtering out cases where volume spikes alone without structural support.

When volume, price action, and momentum indicators all align, traders can use combined probabilities rather than relying on a single metric to tell the whole story.

How does complexity affect decision-making?

Traders often review multiple charts, switching between volume bars, RSI readings, and moving averages. They try to determine whether today's signals support a position aligned with their strategy's time frame. The manual method includes checking if a volume spike confirms a weekly swing setup or fits with long-term buying for a multi-year hold.

However, they often second-guess themselves because it can be unclear how short-term changes relate to longer-term trends. As things get more complex and different holding periods require different confirmation methods, this can make it harder to focus and slow response times.

MarketDash sorts volume signals using strategic methods tailored to specific investment time frames. It provides insights that connect weekly chances with short-term volume confirmation, top-ranked stocks with detailed technical agreement, and long-term wealth plans with ongoing accumulation patterns. This process transforms scattered data into actionable decisions that fit your time frame.

What happens when volume spikes unexpectedly?

When a stock's volume triples overnight, and there’s a sharp price jump, it’s hard not to think of this as a trend reversal or breakout confirmation. Investors might jump in quickly, believing the surge indicates a significant shift in sentiment toward the stock.

However, it’s important to recognize that the spike may have come from an already expected earnings report or from a sector rotation that ran out of steam during the session. As a result, momentum often fails to sustain itself because the event that drove the high volume was temporary rather than the beginning of a long-lasting trend.

Why should you not treat all volume anomalies equally?

This mistake becomes larger when traders treat every volume change as equally important. It's important to understand that one-time events create different patterns than slow buying or selling over time.

For example, a large one-day volume jump might indicate panic selling, short-covering, or algorithmic activity, but not necessarily genuine confidence from knowledgeable traders. If traders don't assess whether the following days sustain the initial surge or if volume returns to normal, they risk betting on momentum that may already have run out.

How to assess volume trends over time?

To assess volume trends, start by looking at weekly charts. Figure out if a spike shows the start of a pattern that lasts for multiple sessions or if it's just a one-time event. Watch for secondary confirmation in the next two to three sessions, where volume stays high even if it doesn’t reach the initial peak. This demonstrates sustained interest rather than a short burst.

Include sentiment analysis or news checks to see if the reason for the spike has lasting effects or was just a single surprise. If volume returns to normal after a spike, without any price change, view this as exhaustion rather than the start of something new. It might be best to wait until a stronger pattern appears.

What does declining volume indicate?

Prices may move sideways for weeks, with trading volume slowly declining as the price range narrows. Some traders interpret this as disinterest and decide to close their positions, believing that low activity indicates the trend is fading.

Others don't pay attention to the shrinking volume and keep holding through the wait, not realizing that this situation often precedes explosive moves once more participants join. Both views miss the point that a decrease in volume during this waiting period indicates equilibrium, in which buyers and sellers reach a temporary balance before the next price move.

How can you benefit from declining volume?

The pattern is important because low volume in tight ranges reduces volatility, creating potential energy that can be released when a catalyst encourages traders to re-enter. Stocks that remain steady despite declining volume usually break out more strongly when volume returns.

This occurs because the range has absorbed supply or demand, leaving fewer barriers to directional movement. If traders do not notice this setup, they might exit too early or enter too late, missing the initial push that offers the best risk-reward ratio.

What is the best approach for breakout trading?

To improve breakout trading, treat declining volume during consolidation as a setup phase instead of a warning sign. Monitor the first session when volume significantly exceeds the average during consolidation, while the price breaks the range boundary; this combination is your entry trigger.

Set alerts for volume spikes within established ranges so you are ready to act when the breakout starts, rather than chasing the move after it has extended. This approach changes quiet periods from sources of impatience into chances for prepared positioning, allowing you to capture the momentum surge that follows compression.

How does applying insights enhance trading?

Fixing these mistakes sharpens your edge only if you apply the insights in the most critical areas.

Try our Market Analysis App for Free Today | Trusted by 1,000+ Investors

Consistently using volume insights requires more than knowing the information; it means sorting signals through frameworks aligned with how long you plan to hold your investments. It's important to tell the difference between spikes that show weekly swing trades and those that indicate long-term accumulation patterns.

Many traders gather the right indicators, but they often struggle to translate them into choices that align with their chosen strategy timeframe. As a result, they let opportunities pass them by while trying to determine whether today's volume increase is relevant to a position they want to hold for six months or just six days.

MarketDash helps address these issues by organizing volume analysis by investment horizon. Weekly chances come up for short-term trades, where volume confirms quick momentum. The best stocks mix participation patterns with comprehensive technical and fundamental checks for balanced positioning, while long-term wealth strategies emphasize sustained accumulation that big money signals over several quarters.

The platform makes volume information easier to understand by turning a lot of data into clear, actionable insights based on how you really invest. Are you ready to trade with confidence instead of second-guessing every volume spike? Start your free trial today and join over 1,000 investors who have stopped getting lost in charts and started making confident, volume-supported decisions.

Related Reading

- Ninjatrader Vs Thinkorswim

- Tradestation Vs Thinkorswim

- Ninjatrader Vs Tradingview

- Trendspider Vs Tradingview

- Tradovate Vs Ninjatrader

- Tradestation Vs Ninjatrader

- Tools Of Technical Analysis

- Stock Market Technical Indicators

- Tradingview Alternative

- Thinkorswim Vs Tradingview