Understanding Stock Sentiment Analysis: A Detailed Guide

MarketDash Editorial Team

Author

.png)

Consider this: you're analyzing a stock with strong fundamentals and promising chart patterns, yet it plummets overnight because negative social media buzz triggered a mass selloff. Traditional AI Stock Technical Analysis excels at reading price movements and volume trends, but it often misses the emotional pulse driving those numbers. This guide will show you how stock sentiment analysis fills that gap, giving you the tools to confidently spot trading opportunities by reading market psychology, make smarter investment decisions by understanding what moves crowds, and boost your portfolio returns by acting before sentiment shifts become price action.

That's where MarketDash's market analysis gives you an edge. Our platform decodes social media chatter, news sentiment, and investor emotion across thousands of sources, translating that noise into clear signals you can actually use. Instead of guessing whether bullish momentum will hold or panic selling will accelerate, you'll see sentiment trends mapped alongside technical indicators, helping you enter positions when optimism is building and exit before fear takes over.

Summary

- Stock sentiment analysis evaluates emotional tone across social media, news, and financial forums to gauge investor psychology before it fully appears in price movements. Research shows this approach can predict market movements with up to 87% accuracy by transforming unstructured commentary into quantifiable data. Traditional metrics like earnings reports tell you what happened last quarter, sentiment analysis reveals what might happen next week by capturing the collective mood that often precedes actual buying or selling pressure.

- Emotional decisions drive 90% of trading choices, according to StockGeist AI research, not purely financial analysis. Fear accelerates selling regardless of fundamentals, while optimism fuels buying that pushes prices beyond rational levels. These psychological forces create measurable patterns that repeat across market cycles. The lag between sentiment shifts and price movements creates exploitable windows for investors tracking emotional data to enter positions before rallies become obvious or exit before corrections materialize.

- Combining sentiment with technical indicators improves stock prediction accuracy by 15-20% compared with technical analysis alone, according to studies on social media sentiment. The combination works because sentiment reveals why prices might move, while technicals show when momentum is building or breaking. A stock showing oversold conditions gains more conviction when sentiment shifts from extreme negativity to neutral, creating higher-probability entry points where both psychological capitulation and a technical setup align.

- Twitter generates approximately 500 million tweets per day, creating a substantial stream of real-time investor sentiment that often precedes measurable shifts in buying or selling pressure. Platforms like Reddit reveal persistent frustration when stocks with excellent earnings plummet because broader risk-off sentiment dominates conversations. This disconnect between financial data and social sentiment creates the exact opportunities sentiment analysis aims to capture, surfacing when fear peaks or optimism builds before those emotions translate into price action.

- Automated systems generate 80% of financial news, according to research from AIM Multiple, flooding the information landscape with algorithmically produced content that rehashes existing stories without adding genuine insight. This creates massive volume that appears to reflect widespread attention but actually represents machine-generated noise. Without filtering mechanisms that distinguish authentic engagement from artificial amplification, sentiment scores become unreliable precisely when they spike most dramatically, requiring multi-layered verification to separate meaningful signals from coordinated manipulation or bot activity.

- News sentiment shows the strongest predictive power within 24 to 48 hours of publication, with accuracy declining by 30% after 72 hours, according to research on temporal dynamics. This narrow window requires real-time monitoring that most individual investors cannot manually maintain across thousands of sources. Market analysis addresses this by curating sentiment trends alongside technical and fundamental indicators, transforming overwhelming information streams into filtered signals that surface when psychological shifts align with other analytical factors.

What Is Stock Sentiment Analysis, and What Is It Used For?

Stock sentiment analysis evaluates the emotional tone and opinions expressed about companies and their shares across digital platforms, social media, news outlets, and financial forums. It uses natural language processing and machine learning to classify text as positive, negative, or neutral, then aggregates these signals to gauge investor psychology. Traders and analysts use it to anticipate price movements before they fully appear in charts, identify mispricings driven by fear or optimism, and time entries or exits with greater precision.

The approach transforms unstructured commentary into quantifiable data. When thousands of investors discuss a stock, their collective mood often precedes actual buying or selling pressure. Stock sentiment analysis can predict market movements with up to 87% accuracy, demonstrating how effectively emotional signals translate into actionable forecasts. This matters because traditional metrics, such as earnings reports and balance sheets, tell you what happened last quarter, while sentiment analysis shows you what might happen next week.

Why Non-Financial Factors Shape Valuations

Company reputation, social media buzz, and broader public perception drive demand independently of financial statements. A firm can report strong earnings yet see its stock plummet if negative sentiment dominates investor conversations. The reverse also holds true. When optimism builds around a brand or sector, prices often rise before fundamentals catch up.

The pattern surfaces repeatedly across markets. Chinese equities, such as JD, traded at distressed multiples despite solid cash flows and balance sheets because global investors adopted a "China Bad" narrative. Nothing changed fundamentally, yet prices fell from over $100 to below $30 as collective pessimism overwhelmed valuation logic.

Sentiment-driven sell-offs persist until they don't, then reverse sharply once capital flows return. Alibaba surged 70% as sentiment improved, while JD historically lagged before catching the broader rally. Monitoring these emotional shifts across peer companies reveals when category-wide sentiment is changing, creating opportunities where perception diverges from reality.

How Emotional Decisions Drive Market Behavior

Research from StockGeist AI indicates that 90% of trading decisions are driven by emotions rather than purely analytical factors. Fear accelerates selling. Optimism fuels buying. Greed pushes prices beyond rational levels. Panic creates capitulation. These aren't abstract concepts; they're measurable patterns that repeat across every market cycle.

When fear dominates, stocks get abandoned regardless of fundamentals. When optimism returns, volumes rise, short interest falls, and prices recover faster than most anticipate. The lag between sentiment shifts and price movements creates exploitable windows. If you wait until the rally is obvious, you've missed the entry. If you rely solely on earnings and cash flow, you're ignoring the psychological forces that actually move prices in the short to medium term.

Integrating emotional data into forecasting models improves predictive accuracy by capturing real-time reactions that balance sheets miss. Traditional methods tell you a company is undervalued. Sentiment analysis indicates whether sentiment is positive yet and when it might change.

Practical Applications Beyond Forecasting

Sentiment analysis supports risk management by surfacing emerging concerns before they become crises. A sudden spike in negative commentary around product quality, regulatory scrutiny, or executive behavior often precedes official announcements. Catching these signals early allows you to reduce exposure or hedge positions before broader markets react.

It also informs timing for portfolio adjustments. Entering a position when pessimism peaks and fundamentals remain strong offers better risk-reward than buying after sentiment has already turned positive. Exiting when euphoria builds and everyone expects continued gains, protects profits before inevitable corrections. The challenge isn't knowing whether sentiment matters; it's filtering meaningful signals from noise across thousands of sources without drowning in data.

Platforms like MarketDash address this by curating sentiment trends alongside technical and fundamental indicators, transforming overwhelming information into clear signals. Instead of manually tracking social media, news feeds, and forum discussions, you see aggregated sentiment mapped to price action, helping you identify when optimism is building or fear is accelerating. This filtering mechanism aligns with a multi-strategy approach, supporting both short-term trading opportunities and long-term wealth-building decisions without overwhelming you with raw data.

How Sentiment Evaluation Actually Works

The process starts by scraping text from publications, earnings transcripts, social platforms, and user-generated content. Natural language processing breaks this material into analyzable units, removing irrelevant elements like stop words and standardizing formats. Machine learning models then classify expressions as favorable, unfavorable, or neutral based on patterns learned from labeled training data.

Advanced techniques use neural networks to handle linguistic nuances like sarcasm, context-dependent meaning, and industry-specific jargon. A phrase like "this stock is dead" might indicate pessimism in most contexts, but could signal opportunity in contrarian investing discussions. Sophisticated models adapt to these subtleties, improving classification accuracy over time as they process more examples.

Once classified, sentiment scores aggregate across sources and timeframes. A single negative tweet means little. A sustained shift from neutral to negative sentiment across hundreds of sources over several days signals a change in investor psychology. These aggregated scores feed into dashboards, alerts, and predictive models that traders use to inform decisions.

But raw sentiment data alone doesn't guarantee better outcomes. The real edge comes from knowing which sources carry predictive weight, which timeframes matter for your strategy, and how to combine sentiment with other indicators without creating false confidence.

That's where the quality of your data sources becomes the difference between signal and noise.

Related Reading

- AI Stock Technical Analysis

- What is Automated Trading

- What is Backtesting in Trading

- How To Use the Fib Retracement Tool

- Do Hedge Funds Use Technical Analysis

- What is SMA in Stocks

- Fundamental Analysis vs Technical Analysis

- How to Do Technical Analysis of Stocks

- How to Read Stocks

- Bar Chart vs Candlestick

- Day Trading Patterns

- How to Analyze a Stock Before Investing

- Volume Technical Analysis

- Double Top Chart Pattern

What Data Sources Are Used For Stock Sentiment Analysis?

Sentiment analysis draws from platforms where investors, analysts, and the public express opinions about companies and markets. These sources range from structured financial publications to unstructured social chatter, each offering distinct signals about collective psychology. The value lies not in any single source but in how patterns emerge when you aggregate signals across multiple channels, revealing shifts in perception before they fully appear in price action.

The challenge isn't accessing these sources. Most are public and readily available. The real difficulty is filtering meaningful sentiment from the noise generated by millions of daily posts, articles, and reports. Without curation, you end up drowning in data rather than extracting actionable intelligence.

Social Platforms Where Sentiment Forms in Real Time

Twitter generates approximately 500 million tweets per day, creating an enormous stream of real-time investor sentiment. Platforms like X (formerly Twitter), Reddit, and StockTwits serve as real-time sentiment indicators, where traders share reactions to earnings, product launches, regulatory news, and market moves. The volume matters because collective expressions of fear, optimism, or confusion often precede measurable changes in buying or selling pressure.

Reddit communities like r/StockMarket reveal a persistent frustration when sentiment diverges from fundamentals. Investors watch stocks with excellent earnings plummet because broader risk-off sentiment dominates conversations. They see companies trading at distressed valuations despite strong balance sheets because negative narratives spread faster than financial reports update. This disconnect between financial data and social sentiment creates the very opportunities sentiment analysis aims to capture.

The emotional intensity on these platforms provides early warning signals. When language shifts from neutral discussion to expressions like "makes no sense" or "absurdly cheap," you're witnessing sentiment extremes that often mark inflection points. Tracking these shifts across thousands of users reveals when fear peaks or optimism builds, providing timing signals that balance sheets can't.

News Outlets and Financial Publications

Bloomberg, Reuters, CNBC, and sector-specific publications aggregate expert analysis, breaking news, and market commentary. These sources carry institutional weight. When major outlets shift tone on a sector or company, that change ripples through investor psychology faster than quarterly reports. Language analysis of headlines and articles reveals whether coverage is becoming more cautious, optimistic, or neutral over time.

RSS feeds from these outlets enable continuous monitoring of how narratives evolve. A steady stream of positive coverage builds confidence. A sudden increase in articles questioning growth prospects or highlighting risks signals a shift in sentiment before price adjustments fully reflect it. The lag between narrative change and market reaction creates exploitable windows for those systematically tracking these sources.

Financial blogs and analyst commentary add depth beyond headline news. These pieces often explore concerns such as capital expenditure trends, competitive threats, or regulatory risks that don't immediately translate into price movements but shape medium-term sentiment. Aggregating this commentary across multiple sources surfaces emerging themes that individual articles might miss.

Company Communications and Regulatory Filings

Earnings call transcripts, press releases, and SEC filings contain more than financial data. The language executives use to describe performance, outlook, and challenges carries sentiment signals. A shift from confident language about growth prospects to cautious phrasing about headwinds often precedes analyst downgrades and price corrections. Natural language processing tools detect these tonal changes by analyzing word choice, sentence structure, and the ratio of positive to negative expressions.

Research examining sentiment across 87 company websites over seven years found meaningful correlations between expressed tones and subsequent stock price movements. The banking sector was particularly sensitive to these variations. When corporate communications become more cautious or defensive, that sentiment shift often precedes a deterioration in financial metrics that would alarm traditional analysts.

Quarterly and annual reports provide structured data but also narrative context. Management discussion sections reveal how companies frame challenges and opportunities. Comparing this language quarter over quarter shows whether confidence is building or eroding, independent of the numbers themselves. This matters because markets often react to management tone before reacting to the actual financial results.

Economic Data and Macro Indicators

Government reports on employment, inflation, GDP growth, and consumer confidence shape broad market sentiment. These releases don't target individual stocks but influence overall risk appetite. When economic data surprises positively, sentiment across equities generally improves. Negative surprises trigger risk-off behavior, which can drag down even fundamentally strong companies.

Central bank communications carry outsized sentiment weight. Federal Reserve statements, ECB policy updates, and commentary from other major central banks move markets because they signal future monetary conditions. Analyzing the language in these communications reveals whether policymakers are becoming more hawkish or dovish, which directly impacts investor willingness to hold risk assets.

Tracking these macro sentiment drivers alongside company-specific signals provides context for price movements. A stock falling despite strong earnings might reflect broader risk-off sentiment driven by economic concerns rather than company-specific issues. Understanding this distinction helps you avoid misinterpreting price action as fundamental weakness when it's actually sentiment-driven volatility.

Financial Forums and Discussion Boards

Platforms such as Seeking Alpha, Yahoo Finance message boards, and specialized investing forums host detailed discussions on valuation, strategy, and market outlook. These conversations reflect retail and semi-professional investor sentiment. While individual posts carry little weight, patterns across thousands of discussions reveal collective psychology.

When forum sentiment shifts from debating valuations to expressing confusion or frustration, that emotional change often precedes capitulation or reversal. The language used in these spaces becomes more extreme at sentiment peaks and troughs. Detecting these linguistic patterns provides timing signals that complement technical and fundamental analysis.

The gap between what these discussions emphasize and what financial reports highlight reveals where perception diverges from reality. When forums obsess over capital expenditure concerns while earnings remain strong, you're seeing sentiment-driven fear that creates potential mispricings. These disconnects create opportunities for patient capital to enter positions before sentiment normalizes.

Filtering Signal From Overwhelming Noise

Accessing these data sources is straightforward. Making sense of them isn't. Manual tracking across social platforms, news feeds, company filings, and economic reports quickly becomes impossible at scale. You need aggregation that preserves signal while eliminating noise, surfacing meaningful sentiment shifts without burying you in raw data.

Most sentiment analysis failures do not stem from flawed data sources but from inadequate filtering. Platforms that curate sentiment trends alongside technical and fundamental indicators transform overwhelming information into clear signals. Instead of monitoring thousands of sources yourself, you see aggregated sentiment mapped to price action, revealing when optimism is building or fear is accelerating. This approach aligns with using sentiment as a filtering mechanism rather than another data dump, supporting both short-term trading opportunities and long-term wealth-building decisions with greater confidence and clarity.

But having quality data sources and effective filtering only matters if the sentiment signals they produce actually predict price movements with enough accuracy to justify acting on them.

How Accurate Is Sentiment Analysis in Predicting Stock Market Movements?

Sentiment analysis achieves 60-70% accuracy in predicting short-term stock price movements, but that number tells only part of the story. The real power emerges when you combine sentiment with technical indicators and fundamental data. Financial sentiment analysis research shows that standalone sentiment models achieve modest results, whereas hybrid approaches significantly improve accuracy while reducing the false signals that plague single-method strategies.

The gap between hype and reality matters. Investors hear bold claims about near-perfect predictions, then discover that sentiment alone rarely exceeds 75% accuracy in controlled studies. This creates skepticism that dismisses a genuinely useful tool because expectations were set unrealistically high. The truth sits in the middle. Sentiment analysis isn't a crystal ball, but it captures psychological forces that balance sheets miss entirely.

Why Prediction Accuracy Varies So Widely

Performance depends heavily on which stocks you're analyzing, what timeframe you're targeting, and how volatile the broader market behaves. Large-cap technology stocks with heavy social media discussion often generate cleaner sentiment signals than small-cap industrials with limited online chatter. A model trained on Twitter data about Tesla will perform differently from one trained on FDA filing language about pharmaceutical companies.

Market conditions shape results dramatically. During stable periods with low volatility, sentiment shifts carry less predictive weight because price movements stay range-bound regardless of mood changes. During earnings season or major news events, sentiment spikes correlate more strongly with price action as emotions drive actual buying and selling decisions. The same model produces 65% accuracy in calm markets and 80% accuracy during high-volatility windows.

Data quality creates another massive variable. Curated news sources from Bloomberg or Reuters provide cleaner signals than raw Twitter feeds filled with bots, spam, and sarcasm. Advanced models using domain-specific language processing outperform generic sentiment tools because they understand financial jargon, recognize context-dependent phrases, and filter noise more effectively. A phrase like "bloodbath" means something different in market commentary than in general conversation.

The Problem With Standalone Sentiment Models

Relying purely on sentiment ignores fundamental realities that ultimately determine valuations. A company can face negative social media buzz while posting record earnings, strong cash flow, and expanding margins. Short-term pessimism creates opportunity when fundamentals remain solid. Conversely, euphoric sentiment around a company burning cash and missing targets signals danger rather than opportunity.

Sentiment captures psychology, not economics. It tells you what people feel about a stock, not whether the underlying business justifies current prices. This matters because emotions drive short-term volatility, but fundamentals determine long-term returns. Using sentiment without fundamental context means trading on noise rather than signal.

The lag between sentiment shifts and actual price movements varies unpredictably. Sometimes, negative sentiment precedes selling pressure by hours. Other times, prices fall first, and negative sentiment follows as investors rationalize losses. Research on temporal dynamics indicates news sentiment shows the strongest predictive power within 24 to 48 hours of publication, with accuracy declining by 30% after 72 hours. This narrow window requires real-time monitoring that most individual investors can't manually maintain.

How Combining Methods Transforms Results

Pairing sentiment with technical indicators produces measurably better outcomes than either approach alone. Studies on social media sentiment found that combining Twitter sentiment analysis with technical indicators improved stock prediction accuracy by 15-20% compared with technical analysis alone. The combination works because sentiment reveals why prices might move, while technicals show when momentum is building or breaking.

A stock showing oversold technical conditions gains greater conviction when sentiment shifts from extreme negativity to neutral. You're seeing both psychological capitulation and technical setup align, creating higher-probability entry points. The reverse applies at the tops. When sentiment reaches euphoric levels while technical indicators show overbought conditions and weakening momentum, the combined signal warns of impending corrections more reliably than either metric alone.

Machine learning models that integrate sentiment, price history, volume patterns, and fundamental ratios consistently outperform single-factor approaches. These hybrid systems learn which combinations predict best under different market regimes. During risk-off periods, they weight sentiment shifts more heavily. During earnings-driven rallies, they emphasize fundamental surprises. This adaptive weighting captures value from sentiment without overreliance.

Platforms like MarketDash address the integration challenge by curating sentiment trends alongside technical setups and fundamental screens. Instead of building your own hybrid models or manually correlating sentiment with price action, you see pre-filtered signals where multiple factors align. This transforms sentiment from another data stream, which requires interpretation, into actionable intelligence that complements, rather than replaces, traditional analysis.

What Accuracy Numbers Actually Mean in Practice

A 70% accuracy rate sounds mediocre until you consider what it enables. If you make 100 trades and 70 prove profitable, that edge compounds dramatically over time, assuming proper position sizing and risk management. Professional traders don't need 90% accuracy. They need a consistent edge that tilts probabilities in their favor across many positions.

The real question isn't whether sentiment analysis achieves perfect predictions. The question is whether incorporating sentiment into your decision-making process improves outcomes compared with ignoring it entirely. The evidence says yes, but only when implemented thoughtfully. Chasing every sentiment spike without confirming signals through other methods generates whipsaw losses. Using sentiment as one input among several creates filtering that improves both timing and conviction.

Many investors expect sentiment tools to tell them exactly when to buy and sell. That's not how probability-based forecasting works. Sentiment analysis identifies when conditions favor certain outcomes over others. It raises or lowers your confidence in positions you're already considering based on other factors. This subtle shift in how you size positions and manage risk produces better results than seeking binary yes-no signals.

The Nuances Models Still Miss

Sarcasm, irony, and context-dependent language remain challenging even for sophisticated natural language processing systems. A comment like "great job tanking the stock" carries negative sentiment despite containing the word "great." Models trained on general language struggle with these inversions. Financial-specific models perform better but still miss subtleties that humans catch instantly.

Sudden news events can override accumulated sentiment patterns in minutes. A surprise regulatory announcement, an unexpected earnings miss, or a geopolitical shock can reset sentiment faster than models can adapt. The lag between the event, the sentiment shift, and the price adjustment compresses so tightly that predictive value disappears. This matters because sentiment analysis fails precisely when volatility spikes, when accurate forecasting matters most.

Manipulation and coordinated campaigns distort sentiment signals. Organized groups can flood social platforms with positive or negative commentary to move prices, especially in smaller stocks with limited liquidity. Detecting and filtering these artificial sentiment surges requires additional layers of analysis that many tools lack. Without this filtering, you're trading on manufactured signals rather than genuine investor psychology.

When Sentiment Analysis Works Best

Short-term traders gain more from sentiment signals than long-term investors because emotions drive near-term volatility more than sustained trends. If you're holding positions for years, quarterly sentiment fluctuations matter less than fundamental business performance. If you're trading weekly options or swing trading over days, sentiment shifts provide timing signals that fundamentals can't offer.

Stocks with high social media engagement and frequent news coverage generate more reliable sentiment data than obscure companies with limited discussion. The sample size matters. Analyzing sentiment from 10,000 daily mentions produces more stable signals than 100 mentions. This creates a natural bias toward larger, more actively traded stocks, where sentiment analysis delivers higher accuracy.

Combining sentiment with contrarian positioning often produces the strongest results. When extreme negativity meets solid fundamentals, you're identifying fear-driven mispricings. When euphoria meets deteriorating fundamentals, you're spotting distribution before broader markets recognize it. This approach uses sentiment as a psychological gauge rather than a momentum indicator, aligning with value-oriented strategies that profit from emotional extremes.

The challenge lies in accessing quality sentiment data, filtering it effectively, and integrating it with other analytical methods without creating decision paralysis. Most investors lack the time or technical capability to build these systems themselves. That's where curated platforms transform sentiment from theoretical advantage into practical edge.

But knowing sentiment analysis can boost accuracy only helps if you understand which specific platforms and tools actually deliver reliable signals worth acting on.

Related Reading

- Ai Quantitative Trading

- Penny Stock Analysis

- Stock Sentiment Analysis

- Technical Analysis Trading Strategies

- Trading Exit Strategies

- Ai Swing Trading

- Best Indicators For Day Trading

- Volume Analysis Trading

- How To Scan Stocks For Swing Trading

- How To Find Stocks To Day Trade

- Best Stock Trading Strategies

- Best Stock Indicators For Swing Trading

5 Best Sentiment Analysis Platforms for Stock Market Pricing

Selecting the right sentiment platform depends on whether you need real-time social tracking, professional-grade behavioral signals, or AI-driven scoring that blends multiple data types. The strongest tools filter noise effectively, surface actionable shifts in investor psychology, and integrate sentiment with technical or fundamental context rather than presenting raw data dumps. Platforms that combine sentiment with other analytical layers deliver significantly better predictive value than standalone sentiment trackers. What follows are five platforms distinguished by how they transform collective market mood into tradeable intelligence.

1. MarketDash

MarketDash is an AI-powered investment platform that supercharges stock investing by delivering hand-curated stock picks, expert-driven analysis, and strategic insights to help investors make faster, more confident decisions. It combines artificial intelligence with professional-level research to cut through information overload, spotlight high-potential opportunities across different time horizons, and provide clear guidance on undervalued stocks, rebounds, and long-term wealth builders, making it especially useful for anyone looking to streamline their approach to market analysis and stock selection.

Key Features

- AI-powered insights via MarketDash AI™ for generating expert-level analysis on selected stocks.

- Hand-curated stock picks categorized into Weekly Opportunities (short- to medium-term gains), Top Rankings (based on fundamentals, technicals, and market positioning), and Long-Term Wealth (focused on stability, growth, and compounding).

- Comprehensive stock reports including Fundamental Analysis (evaluating undervaluation, growth potential, and financial health), Mid-Long Term Strategy (targeting rebounds, surges, and long-term positioning), Trading Strategy (for opportunistic plays), and Dividend Strategy (for income-focused wealth building).

- Weekly updated opportunity picks with detailed opportunity analysis highlighting value buys, turnarounds, and momentum setups.

- Top stock rankings are derived from a blend of fundamental metrics, technical indicators, and current market positioning.

- Long-term wealth-focused selections emphasizing buy-and-hold strategies with compounding potential.

- Header-highlighted tools include AI SWOT Analysis, Insider Trades tracking, Hedge Fund Tracking, Wall Street Analysts' views, and Fundamental Metrics integration for deeper stock evaluation.

Why Investors Choose It

Investors turn to MarketDash because it saves significant time and reduces the stress of sifting through endless data by offering pre-analyzed, expert-curated picks and strategies tailored to various goals—whether chasing quick rebounds, building ranked portfolios, or accumulating stable long-term holdings.

The platform's AI-driven approach delivers actionable insights that boost confidence in identifying undervalued gems or poised performers, while its structured reports and categories address common pain points such as uncertainty and information overload. With a free premium trial and a focus on helping users invest smarter, it appeals to both newer investors building portfolios and seasoned investors seeking an edge in identifying opportunities before broader recognition.

2. StockGeist.ai

StockGeist.ai is a specialized real-time sentiment tracker that monitors social media and news for thousands of publicly traded companies, delivering immediate insights into market attention and emotional tone to inform pricing expectations.

Key Features

- Real-time ranking of stocks by message volume and attention shifts over short intervals like minutes or hours.

- Separation of messages into positive, negative, emotional, and informative categories for deeper context.

- Visual word clouds highlight frequent topics and phrases in discussions.

- Timelines showing sentiment evolution and the impact of major events.

- Coverage of over 2,200 companies, focusing on major indices like the S&P 500 and the Nasdaq 100.

- Historical sentiment data access up to one month for pattern analysis.

- An interactive dashboard with charts like candles, lines, or areas for sentiment plots.

3. Stocktwits

.webp)

Stocktwits operates as a dedicated social network for investors, where active discussions create a vibrant source of crowd-sourced sentiment that directly ties to trending stocks and potential price reactions.

Key Features

- Real-time trending lists for stocks, ETFs, and crypto based on message volume and sentiment changes.

- Community-driven bullish/bearish labels on posts for straightforward polarity tracking.

- AI-powered summaries of ongoing conversations and focus areas.

- Metered sentiment scores (0-100) combining activity levels and message tone.

- Direct integration of user interactions like polls, earnings discussions, and watchlists.

- High engagement from millions of users for the rapid detection of mood swings.

- Visual tools such as heatmaps and activity surges to spot emerging opportunities.

4. SentimenTrader

SentimenTrader delivers a professional, data-centric approach to market sentiment by aggregating behavioral signals from options activity, fund flows, surveys, and positioning data rather than relying solely on social chatter, helping users identify extremes that frequently precede reversals or continuations in stock pricing.

Key Features

- Smart Money vs. Dumb Money Confidence indices comparing savvy professionals against retail crowd tendencies.

- Over 2,800 proprietary and classic indicators covering sentiment, breadth, trend, seasonality, macro, and price patterns.

- Backtesting engine with thousands of historical indicators for strategy validation.

- Daily reports, such as SentimentEdge for behavioral insights and ModelEdge for quantitative risk/opportunity models.

- Composite scores, such as the Sentiment Cycle (panic-to-confidence phases), for trend-following guidance.

- Real market data integration from options, futures, and investor flows for objective signals.

- Tools to identify sentiment extremes that signal potential turning points in equities and broader markets.

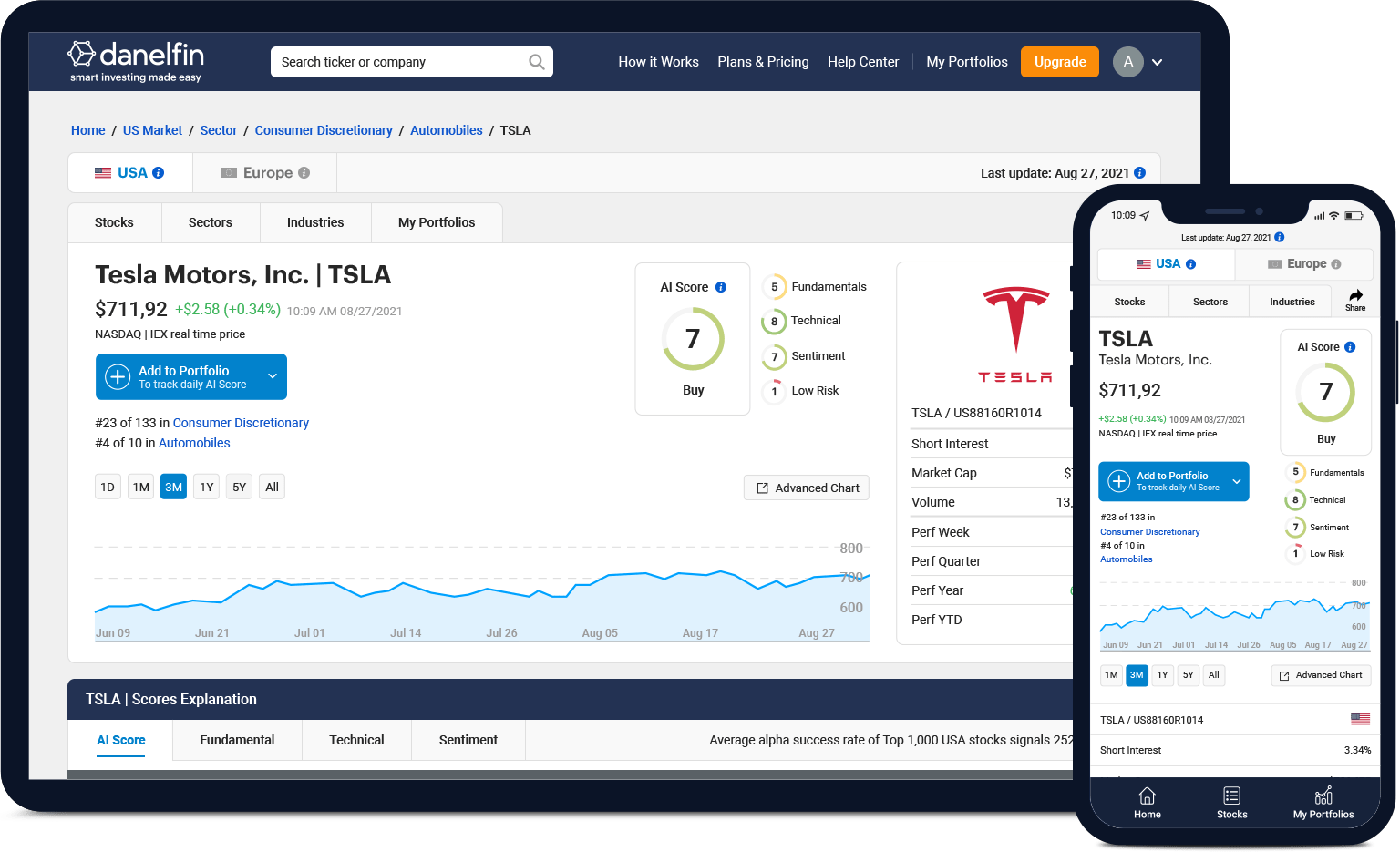

5. Danelfin

Danelfin is an AI-powered stock-scoring platform that integrates sentiment signals with technical and fundamental data to forecast short-term outperformance relative to benchmarks such as the S&P 500, giving users a clear edge in anticipating price moves driven by shifting market sentiment.

Key Features

- AI scores are the probability that a stock will outperform the S&P 500 over the next three months.

- Integration of over 150 sentiment indicators pulled from news, social media, and other sources.

- Analysis of more than 10,000 features per stock or ETF for comprehensive evaluation.

- Daily updated rankings highlighting high-probability outperformers based on blended signals.

- Explainable AI breakdowns showing which sentiment, technical, or fundamental factors drive each score.

- Coverage across thousands of U.S. stocks and ETFs with historical performance tracking.

- Portfolio tools to compare and optimize holdings according to combined sentiment-driven predictions.

Each platform addresses different aspects of sentiment analysis, from real-time social tracking to professional behavioral signals to AI-driven scoring. The right choice depends on your trading timeframe, preferred data sources, and whether you want raw sentiment feeds or pre-filtered intelligence. Most sophisticated investors combine insights from multiple platforms, using social sentiment for timing, behavioral data for confirmation, and AI scoring for systematic selection.

But even the best platforms can't eliminate the fundamental challenges that make sentiment analysis harder than it appears at first glance.

Challenges in Stock Sentiment Analysis, and How to Overcome Them

The obstacles in sentiment evaluation aren't technical problems waiting for better algorithms. They're human problems embedded in how language works, how markets behave, and how emotions distort information at scale. Overcoming them requires recognizing that raw sentiment data carries inherent flaws that no amount of processing can fully eliminate, and then building systems that filter noise, adapt to context, and validate signals through multiple lenses before acting.

Sarcasm and Linguistic Ambiguity Derail Classification

A trader posts "Great, another brilliant earnings miss" after a company reports disappointing results. The words "great" and "brilliant" are classified as positive by basic sentiment models, which misses the obvious sarcasm. This occurs frequently across financial forums and social platforms, where irony, mockery, and context-dependent phrasing dominate discussions. Static language models trained on general text struggle because financial conversations carry specialized meanings that shift based on tone, timing, and audience.

The problem compounds when phrases flip meaning depending on who's speaking. The phrase "This stock is dead" may signal capitulation from a frustrated retail investor or an opportunity for a contrarian value buyer. Without understanding speaker intent and conversational context, models misclassify genuine sentiment at rates high enough to generate false signals that cost money. Advanced natural language processing helps by training on financial-specific corpora and incorporating contextual awareness, but even sophisticated systems miss subtleties that human readers catch instantly.

Hybrid approaches that combine rule-based filters with deep learning reduce misclassification by capturing common sarcastic patterns while allowing neural networks to handle novel expressions. Continuous retraining on recent financial discussions keeps models aligned with evolving slang and emerging phrases. The gap narrows but never closes completely, which is why relying solely on automated sentiment classification without human curation or validation through other analytical methods remains risky.

Volume Overwhelms Signal Quality

80% of financial news is generated by automated systems, flooding the information landscape with algorithmically produced content that often rehashes existing stories without adding genuine insight. This creates massive volume that appears to reflect widespread attention but actually represents machine-generated noise. When sentiment tools aggregate across these sources, they count duplicate narratives multiple times, artificially amplifying signals that don't reflect actual investor psychology.

Social platforms compound this with bot activity, coordinated campaigns, and spam that mimic genuine discussion. A stock suddenly trending on Twitter might reflect organized manipulation rather than organic interest. Without filtering mechanisms that distinguish authentic engagement from artificial amplification, sentiment scores become unreliable precisely when they spike. The challenge isn't just processing volume; it's also validating that the volume reflects genuine human sentiment worth analyzing.

Addressing this requires multi-layered verification. Source credibility scoring weights favor analysts and verified accounts over anonymous posts. Activity pattern analysis detects coordinated behavior that suggests manipulation. Cross-platform validation checks whether sentiment shifts appear consistent across independent sources or concentrate suspiciously in a single channel. These filters reduce noise but add complexity that most individual investors lack the resources to implement themselves.

Market Psychology Shifts Faster Than Models Adapt

External shocks such as regulatory announcements, geopolitical events, or unexpected earnings surprises can trigger sentiment reversals within minutes. A stock trading with bullish sentiment based on accumulated positive discussions can plummet on breaking news before models register the shift. The lag between events, sentiment changes, and model updates creates windows during which analysis reflects outdated psychology that no longer drives price action.

Collective behavior introduces additional unpredictability. Herd mentalities amplify initial movements beyond rational levels, creating feedback loops where rising prices generate optimism that drives further buying regardless of fundamentals. Fear operates similarly in reverse, triggering cascading selling that overwhelms any stabilizing sentiment. These psychological dynamics defy straightforward modeling because they're self-reinforcing and context-dependent, making historical patterns unreliable guides to current behavior.

Real-time monitoring with low-latency data feeds helps narrow response gaps, but even millisecond advantages matter less when the underlying psychology driving markets becomes irrational. Blending sentiment with circuit-breaker logic that pauses signals during extreme volatility prevents acting on temporary panic or euphoria. Scenario-based simulations that stress-test how sentiment models perform during past shocks reveal which signals remain predictive under pressure and which collapse into noise.

Integrating Qualitative Sentiment With Quantitative Metrics

Merging subjective mood assessments with objective financial data demands specialized frameworks that harmonize incompatible data types. Sentiment scores exist on arbitrary scales (positive/negative/neutral or numerical ratings) that don't directly map to earnings multiples, cash flow ratios, or price momentum indicators. Without proper normalization and weighting, combining these elements can either dilute valuable signals or create false precision when sentiment and fundamentals contradict.

The temptation is to treat sentiment as just another numerical input to throw into predictive models. That approach fails because sentiment has different predictive power across market conditions, stock characteristics, and timeframes. During earnings season, sentiment shifts matter more than during quiet periods. For momentum stocks with high social engagement, sentiment predicts better than for value stocks with limited discussion. Static weighting ignores these contextual variations, producing inconsistent results that erode confidence in the entire approach.

Adaptive models that adjust sentiment influence based on the current market regime, stock-specific characteristics, and recent prediction accuracy partially address this. Ensemble methods that run parallel models with different sentiment-fundamental balances and then weight outputs based on recent performance provide robustness against any single approach failing. The sophistication required to implement these techniques properly exceeds what most investors can build themselves, which is where curated platforms that handle the integration become valuable.

Data Privacy Constraints Limit Access and Utility

Scraping user-generated content from forums, social media platforms, and discussion boards raises legal and ethical questions regarding consent and data use. Regulations such as GDPR impose strict requirements on the collection, storage, and processing of personal information, even when it is publicly available. Non-compliance risks and penalties are severe enough to shut down analysis operations, yet overly cautious approaches that anonymize or restrict data access reduce signal quality to the point where analysis loses predictive value.

The tension between thorough analysis and ethical safeguards creates operational friction. Platforms must implement encryption, access controls, audit trails, and user consent mechanisms that add cost and complexity. Smaller operations struggle to meet these standards, while larger platforms face ongoing compliance burdens that divert resources from improving analytical capabilities. Users who are rightfully concerned about privacy may avoid platforms that aggregate their comments, reducing the diversity and quality of available sentiment data.

Balancing these competing demands requires transparent policies that clearly explain data usage, robust security that protects sensitive information, and compliance frameworks that satisfy regulatory requirements without crippling analytical utility. Platforms that handle this well build trust that expands their data access over time, while those that cut corners face erosion of both user participation and legal standing. For investors evaluating sentiment tools, understanding how platforms address privacy and compliance provides insight into long-term reliability and data quality.

Most teams handle sentiment analysis by subscribing to multiple data feeds and manually correlating signals across platforms, trying to catch meaningful shifts before they fully appear in prices. As market complexity increases and signal sources multiply, this approach fragments attention across too many dashboards, buries actionable insights under contradictory indicators, and stretches response times to the point that opportunities pass. Platforms like MarketDash address this by filtering sentiment trends through AI-powered curation that surfaces pre-validated signals where psychological shifts align with technical setups and fundamental strength, compressing hours of manual correlation into clear decision points without overwhelming you with raw data streams.

Models Decay Without Continuous Updating

Sentiment patterns that predicted accurately six months ago lose effectiveness as language evolves, market participants change, and new discussion platforms emerge. A model trained on 2022 Twitter data misses the linguistic shifts and platform migrations that have occurred since. Without regular retraining on current data, classification accuracy degrades steadily as the gap between the training corpus and real-world usage widens.

The decay happens faster than most realize. Slang enters financial discussions within weeks. New tickers generate specialized jargon almost immediately. Platform algorithm changes alter what content surfaces and how users engage. A static model becomes increasingly misaligned with current reality, generating classifications based on outdated patterns that no longer reflect actual sentiment. This creates a silent performance decline: predictions appear reasonable, but accuracy falls below useful thresholds.

Continuous learning pipelines that retrain models on rolling windows of recent data maintain relevance, but they require infrastructure for data collection, labeling, validation, and deployment that demands ongoing investment. Automated retraining introduces risks of models learning from temporary anomalies or incorporating manipulated data without proper filtering. Balancing update frequency with stability and quality control is an operational challenge that compounds the technical difficulty of sentiment analysis.

Yet even with perfect models, pristine data, and sophisticated integration, one question remains unanswered: does the effort actually translate into better portfolio outcomes, or just more impressive dashboards?

Try our Market Analysis App for Free Today | Trusted by 1,000+ Investors

Sentiment analysis offers powerful signals, but only when filtered through systems that eliminate noise, validate patterns, and integrate psychological data with fundamental and technical context. Building that infrastructure yourself means months of testing models, curating data sources, and correlating signals across platforms while opportunities pass.

MarketDash solves this by delivering hand-curated stock picks where AI-powered sentiment analysis already aligns with expert evaluation, technical setups, and fundamental strength. You see pre-filtered opportunities across Weekly Opportunities for near-term gains, Top Rankings based on blended metrics, and Long-Term Wealth picks emphasizing compounding potential, without drowning in raw sentiment feeds or contradictory indicators.

The platform tracks insider trades, hedge fund positioning, and Wall Street analyst views alongside sentiment shifts, revealing when optimism builds before broader recognition or when fear creates entry points despite solid fundamentals. Instead of manually monitoring social platforms, news cycles, and forum discussions to catch psychological inflections, you access aggregated intelligence that shows which stocks warrant attention and why.

This approach directly addresses the frustration of spotting undervalued companies but lacking conviction about timing, or watching sentiment diverge from fundamentals without knowing which signal matters more. Start your free trial today at MarketDash and see how thousands of investors are using curated sentiment intelligence to make more confident decisions with less research time.

Related Reading

• Stock Market Technical Indicators

• Ninjatrader Vs Thinkorswim

• Tradestation Vs Ninjatrader

• Trendspider Vs Tradingview

• Tradovate Vs Ninjatrader

• Ninjatrader Vs Tradingview

• Tools Of Technical Analysis

• Tradingview Alternative

• Thinkorswim Vs Tradingview

• Tradestation Vs Thinkorswim