What is the Moving Average Crossover Strategy? A Detailed Guide

MarketDash Editorial Team

Author

The moving average crossover strategy cuts through market noise by pinpointing when short-term and long-term trends intersect, revealing high-probability entry and exit signals. Recognized as an integral part of AI Stock Technical Analysis, this method transforms complex data into clear insights, reducing the guesswork in timing trades. It offers a systematic approach that enhances decision-making by focusing on critical momentum shifts.

Automatic detection of golden and death crosses further simplifies technical evaluation, enabling traders to respond quickly to market changes. By converting detailed price data into actionable signals, sophisticated systems prevent the overwhelming burden of manual analysis. MarketDash refines this process with tools that automatically monitor moving average interactions, delivering precise insights through market analysis.

Summary

- The moving average crossover strategy identifies trend shifts by tracking when shorter-term averages cross longer-term ones, generating buy or sell signals based on momentum changes. Traders commonly use the 50-day and 200-day moving averages for longer-term analysis, while combinations like the 10-day and 50-day provide quicker signals for active trading. The visual clarity makes it accessible for beginners while remaining useful for experienced traders who want objective, rule-based entry and exit points that eliminate emotional decision-making.

- Standalone crossover signals often underperform passive buy-and-hold strategies after accounting for transaction costs, with win rates typically hovering between 40% and 60%. The delayed entry inherent in lagging indicators means traders capture trends after they've already started, missing the most explosive early moves. Backtests across stocks, forex, and cryptocurrencies show mostly flat or negative performance when applied in isolation, with profitability concentrated in specific trending environments rather than universal success across all market conditions.

- Market type determines the viability of a strategy more than any other factor. Cryptocurrencies on daily or four-hour charts produce some of the few positive backtest results because momentum persists longer after breakouts. Range-bound stocks with low volatility turn crossovers into capital destroyers, triggering repeated entries and exits that bleed accounts through accumulated transaction costs. Higher timeframes filter noise more effectively, with daily and weekly charts consistently outperforming intraday intervals by delivering improved risk-adjusted returns and reduced drawdowns.

- Adding volume confirmation, momentum oscillators such as RSI, and support-and-resistance analysis dramatically improves signal quality by filtering out low-probability setups. A bullish crossover accompanied by volume 50% above the 20-day average suggests institutional participation rather than retail noise. These additional confirmation filters reduce signal frequency by 40-60% and often double win rates by eliminating false signals that occur in choppy, sideways markets, where the strategy struggles most.

- Position sizing based on stop-loss distance prevents any single trade from damaging your account. Calculate the dollar amount you're willing to risk, divide it by the distance between the entry and stop-loss levels, and that determines your share quantity regardless of confidence level. Traders who risk only 1 to 2% per trade and maintain at least a 1:2 risk-to-reward ratio survive inevitable losing streaks that destroy accounts using arbitrary position sizing.

- Testing parameters for at least 50 to 100 trades before making adjustments gives statistical significance time to separate luck from skill. The urge to adjust moving average periods after three consecutive losses destroys more accounts than any market move, because constant optimization prevents the accumulation of sufficient data to evaluate a genuine edge. Successful traders accept that 40 to 50% of signals will fail and focus on whether average winners exceed average losers enough to generate positive expectancy over time.

- Market analysis addresses the core limitation of standalone crossovers by layering fundamental screening and earnings momentum alongside technical signals, helping traders distinguish between crossovers backed by improving business fundamentals versus those driven purely by temporary price fluctuations.

What is the Moving Average Crossover Strategy, and How Does It Work?

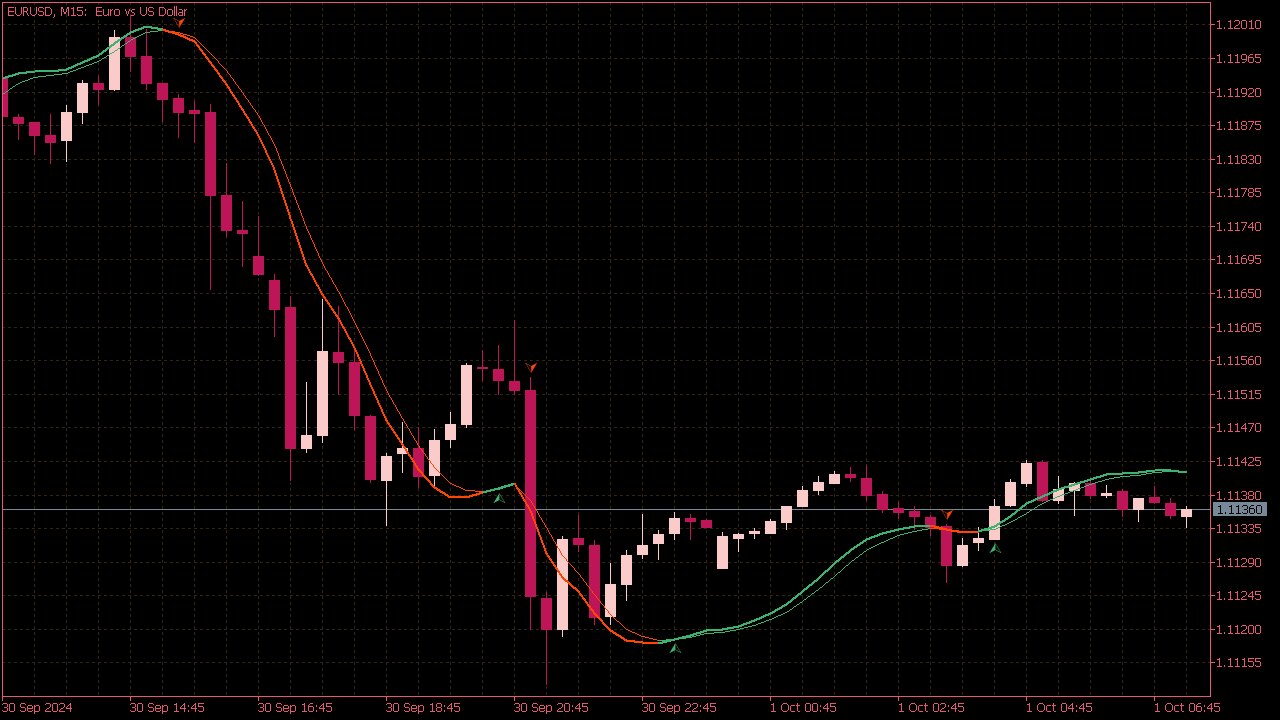

The moving average crossover strategy identifies potential trend shifts by plotting two moving averages on a price chart and watching for their intersection. When a shorter-term average crosses above or below a longer-term average, it generates a buy or sell signal based on momentum changes. This method turns price action into clear, rule-based decisions that remove the guesswork from when to enter and exit trades.

The strategy works by catching moments when recent price behavior differs from historical patterns. A bullish crossover occurs when the fast-moving average crosses above the slow-moving average, indicating increasing upward momentum. On the other hand, a bearish crossover occurs when the fast average falls below the slow one, indicating weakening strength.

Traders use these intersections to align with new trends rather than resist market direction. To effectively track trends, leverage insights from market analysis.

Moving averages help reduce price volatility by averaging closing prices over a certain period. The simple moving average (SMA) treats all prices equally, while the exponential moving average (EMA) gives greater weight to recent data, helping it respond more quickly to new information. Both serve the same purpose: filtering out short-term noise so traders can see the underlying trend without being distracted by daily price changes.

What are the key periods for moving averages?

Traders often use the 50-day and 200-day moving averages for longer-term trend analysis. Shorter timeframes, such as the 10-day and 50-day, provide faster signals for active trading. These averages serve as moving support and resistance levels, helping you determine whether momentum is strengthening or weakening. The periods you choose depend on your trading plan and your risk tolerance.

How do crossovers signal market trends?

The strategy is triggered when the shorter-period moving average crosses above the longer-period moving average. Consider two lines moving across your chart. When the fast line rises above the slow line, it indicates that recent prices are rising faster than the historical average, suggesting buyers are taking control. On the other hand, when the fast line falls below the slow line, it indicates that sellers are in control and prices are below their historical norm.

These crossovers do not predict the future; instead, they confirm what is already happening in the market. The golden cross, where a shorter average, such as the 50-day, crosses above a longer one, such as the 200-day, indicates strong bullish momentum. In contrast, a death cross signals a bearish trend ahead. Both patterns are important because they reflect ongoing shifts in market sentiment rather than temporary price movements.

What makes moving average crossovers appealing?

Moving average crossovers stand out for their simplicity. No advanced technical skills or complex calculations are needed to see a crossover on a chart. This clear visual makes it accessible to beginners and helpful to experienced traders seeking objective rules.

Many traders aim to remove emotion from trading and rely on data-driven strategies. Crossovers provide predefined entry and exit points, eliminating second-guessing.

What are the limitations of moving average crossovers?

The strategy works best in trending markets where prices move steadily in one direction. During these periods, crossover strategies can spot momentum early enough to generate strong profits. Plus, the whole process can be automated using trading bots or scanners.

This allows technology to monitor multiple stocks simultaneously while you focus on other decisions. This mix of simplicity and scalability is why crossovers are still popular in forex, equities, and cryptocurrency markets.

Crossovers come in late by design. Because they calculate averages of past prices, signals only show up after a trend has already started. You will often enter trades after significant moves have occurred, which reduces potential profits.

In sideways or range-bound markets, the strategy struggles. Prices move back and forth without a clear direction, leading to frequent crossovers that give false signals. These whipsaws cause repeated small losses that can weaken your account over time.

How do low-volume periods affect crossover effectiveness?

Low-volume periods make these problems worse. When trading volume is low, price changes can become unpredictable and less significant. Even so, crossovers still occur, even when they can be trusted. This strategy might also lead to exiting winning trends too soon; a short pullback can create a bearish crossover, and the original trend can then continue without the trader.

These situations test a trader's discipline because sticking to the system means accepting some frustrations.

How does market analysis enhance crossover strategies?

Platforms like market analysis solve timing problems by combining moving average crossover signals with fundamental analysis and AI-powered insights. Instead of relying solely on outdated technical indicators, users receive information on whether a crossover reflects underlying value and earnings momentum. This method reduces false signals, making it easier to distinguish real trend changes from temporary noise.

What are common crossover strategies among traders?

Different crossover combinations serve varying trading styles. Swing traders might use a 10-day and 30-day EMA crossover to capture short-term moves that last several days or weeks.

In contrast, position traders prefer the 50-day and 200-day SMA crossover to identify major trends that unfold over months. Some traders layer multiple moving averages on a single chart, waiting for alignment across different timeframes before entering a trade. This approach can enhance your market analysis, making it easier to understand price movements and trends.

This confirmation approach reduces premature entries but also means traders may miss trends earlier.

What are the two common moving average crossover systems?

Traders often use two main moving average crossover strategies: the dual moving average system for simple trend following and the triple moving average system, which includes a third line for confirmation. Each method affects the sensitivity and reliability of the signals. Faster crossovers generate more signals but can also increase false positives.

Slower crossovers give fewer signals, but they might miss quick reversals. Choosing between these strategies depends on whether you want to capture every possible movement or focus only on the strongest trends.

How do predefined rules offer consistency in trading?

The real power of moving average crossovers isn't prediction; it's consistency. By following predefined rules, traders can avoid emotional traps that often lead to account losses.

These traps include holding onto losers too long, cutting winners too early, or freezing when action is required. The crossover signals exactly when to enter and exit, reducing the confusion caused by too many choices.

While this mechanical approach will not guarantee success every time, it helps keep traders active in the market by preventing catastrophic emotional mistakes.

How do successful traders approach moving average crossovers?

Successful traders see moving average crossovers as a framework, not a crystal ball. They know that some signals will not work and that trending markets will eventually move sideways. Entering late is often the cost of getting confirmation.

The discipline needed comes from trusting the system during losing streaks and not giving up after going through a few ups and downs. This mental strength is what sets apart those who make money from crossovers over time from those who stop after their first rough month.

What is the crucial question for trading success?

Understanding how the strategy works is only half the picture. The key question determining whether someone makes money from it is completely different.

Related Reading

- AI Stock Technical Analysis

- What is Automated Trading

- What is Backtesting in Trading

- How To Use the Fib Retracement Tool

- Do Hedge Funds Use Technical Analysis

- What is SMA in Stocks

- Fundamental Analysis vs Technical Analysis

- How to Do Technical Analysis of Stocks

- How to Read Stocks

- Bar Chart vs Candlestick

- Day Trading Patterns

- How to Analyze a Stock Before Investing

- Volume Technical Analysis

- Double Top Chart Pattern

- Quantitative Stock Analysis

How Effective Is A Moving Average Crossover Strategy?

The moving average crossover strategy delivers mixed results, depending heavily on market conditions, timeframe selection, and the context in which it is used. Backtests across stocks, forex, futures, and cryptocurrencies show mostly flat or negative performance when applied alone. Profitability tends to be concentrated in certain trending environments rather than being successful everywhere.

This difference between its popularity and actual performance reveals an uncomfortable truth: accessibility does not guarantee profitability. For a deeper understanding, our market analysis tools can provide insights specific to your trading strategy.

What are the drawbacks of relying solely on crossover signals?

When traders only depend on crossover signals without using extra filters, this strategy usually does worse than just holding assets over time, especially when you think about transaction costs and slippage. Independent tests across various asset classes show win rates of 40% to 60%. Overall returns often suffer due to whipsaws in sideways markets.

Lagging indicators delay entry, meaning traders enter trends only after they have begun. This causes them to miss the most powerful early moves that can lead to significant gains.

How do market conditions affect moving average performance?

The math works against you in choppy conditions. Each false signal costs you two times: first on the losing trade itself, and again because of commissions and spreads that add up with each reversal. Studies of many years of market data show that simple crossover signals struggle to deliver better risk-adjusted returns without information on volume, momentum, or other key market factors.

Are there specific markets where crossovers perform better?

The strategy yields very different results depending on asset characteristics. Cryptocurrencies, especially on daily or four-hour charts, show good results in thorough backtesting because momentum lasts longer after breakouts.

Strong price movements in these markets allow crossovers to capture significant parts of trends before reversals trigger exits.

On the other hand, forex pairs and equity indices often lead to steady losses on shorter timeframes due to unpredictable price movements and frequent directional changes.

Stocks that are stuck in a range with low volatility turn crossovers into money losers, causing repeated entries and exits that weaken accounts through what some call death by a thousand cuts.

This market-specific behavior explains why traders who perform well with crossover strategies are careful about when and where to use this method, rather than applying it everywhere.

What timeframes yield better results?

Longer timeframes filter out noise more effectively, producing fewer but more reliable signals that align with sustained trends. Daily and weekly charts often outperform intraday intervals in backtests, with higher Sharpe ratios and lower drawdowns.

The longer horizon allows moving averages to smooth out temporary volatility spikes, which can cause false signals on shorter scales.

Research shows that performance drops off quickly when using five-minute or fifteen-minute charts. In these cases, frequent crossovers can lead to losses faster than winning trades can offset. The strategy's lagging nature becomes a benefit on longer timeframes, allowing major trends to fully develop before confirmation. Swing traders and position holders benefit from this, while day traders often struggle against the indicator's built-in delay.

Do popular crossover signals guarantee success?

The classic 50-day and 200-day moving average crossover, commonly known as the golden cross (bullish) and death cross (bearish), has had mixed success across market cycles. Some historical studies of major indices report win rates of 60%-79% for long-only strategies. These strategies also exhibit lower maximum losses than unprotected buy-and-hold positions.

While this information appears promising, total returns often lag passive strategies over longer periods. This occurs due to missed rally opportunities and slow re-entries after market corrections.

What role do moving averages play in trading?

Moving averages are effective confirmation tools, not prediction tools. The 50-day and 200-day moving averages are commonly used to spot important trend changes. Their usefulness lies in filtering out small fluctuations rather than catching early changes.

The emotional support that comes from having an objective rule is often more important to traders than small differences in performance. This is why they remain popular, despite only slight statistical advantages.

How can we improve crossover strategies?

Platforms like market analysis address the main problem of standalone crossovers by incorporating fundamental analysis, earnings momentum, and technical signals. When a golden cross appears on a stock with stronger revenue growth and higher margins, it provides technical confirmation of the company's strength rather than merely recognizing a price pattern. This combination reduces the risk of false positives and helps distinguish the crossovers you should act on from those that might reverse quickly.

What optimizations can enhance returns?

Refining moving average periods, switching from simple to exponential smoothing, and adding trend-strength indicators such as the Average Directional Index (ADX) can significantly improve performance in controlled backtests. Some optimized configurations achieve annualized returns around 20% with strong risk-adjusted metrics when tested on good datasets. This improvement results from reducing false signals during consolidation phases while maintaining exposure to real trends.

How does position sizing impact success?

A 55% win rate might seem average at first glance, but this view changes when we consider the risk-reward balance of winning and losing trades. Crossover strategies that allow winners to grow while quickly reducing losses can create positive expectancy even with lower accuracy. The real advantage comes from effective position sizing and risk management applied to the signals, rather than relying solely on the signals themselves.

What mindset helps traders use crossovers?

Traders who view crossovers as probability indicators rather than certainties typically build portfolios that can withstand losing streaks without incurring significant losses. They understand they might receive three or four false signals in a row before a trend emerges that recovers several times the prior losses. This psychological acceptance is what distinguishes those who abandon the strategy after a tough stretch from those who keep going long enough to find the occasional outsized winner that makes the strategy worthwhile.

What factors determine the effectiveness of crossovers?

The question shifts from whether crossovers work for everyone (they do not) to whether we can create conditions that make them work for specific goals and constraints.

To determine when this strategy is appropriate, you need to understand how to use it effectively in live markets rather than relying solely on backtest results.

Related Reading

- Penny Stock Analysis

- Best Indicators For Day Trading

- Technical Analysis Trading Strategies

- Stock Sentiment Analysis

- Ai Quantitative Trading

- Volume Analysis Trading

- Best Stock Indicators For Swing Trading

- How To Scan Stocks For Swing Trading

- How To Find Stocks To Day Trade

- Trading Exit Strategies

- Best Stock Trading Strategies

- Ai Swing Trading

How to Apply the Moving Average Crossover Strategy

Implementation starts with choosing your moving average periods, selecting between simple and exponential smoothing, and setting clear entry and exit rules before you make your first trade. You're creating a mechanical system to take away doubt from decision-making by defining exactly when price changes mean you should change your position. This setup takes only a few minutes to create. However, the discipline to stick to it consistently will decide if you make a profit or end up like many others who give up on the method after their first losing streak.

Your choice of timeframe affects how often you get signals and how reliable they are, which directly impacts your account balance. Day traders using five-minute or fifteen-minute charts might combine a 9-period EMA with a 21-period EMA to capitalize on short-term price movements. They know that many signals won't work, but are willing to take that risk for the chance to capture quick gains.

On the other hand, position traders who hold their investments for weeks or months typically use a combination of the 50-day and 200-day averages. This method helps them ignore daily fluctuations and only confirm longer-term price trends.

What is the impact of moving average periods?

Shorter periods give more signals, but they also raise the chances of whipsaws. Whipsaws can drain your capital because of repeated losses and transaction costs. On the other hand, longer periods significantly reduce the number of signals while improving accuracy on real trends.

Testing different combinations against historical data for your specific assets shows which setups resulted in profitable trades in similar market conditions. Although this analysis looks back and doesn't guarantee future success, it helps you avoid random choices and navigate the market with insight.

Which moving averages should you choose?

Simple moving averages treat every price the same over the lookback period, creating smooth lines that change slowly when sudden price shifts happen. On the other hand, exponential moving averages focus more on recent prices, making them quicker to react to current market movements; however, they can also give false signals during short spikes.

The decision comes down to whether a trader prioritizes stability or responsiveness, especially given their trading style and the extent to which the asset's price fluctuates.

How do EMAs and SMAs perform in different markets?

EMAs perform better in fast-moving markets such as cryptocurrencies and volatile tech stocks. In these situations, delayed signals can lead to missed opportunities.

On the other hand, SMAs are better suited to calmer markets, such as blue-chip stocks or major forex pairs, when volatility is low. In these cases, it is more important to filter out noise than to capture every market change.

Some traders like to use both types. They might use an EMA as the fast line and an SMA as the slow line. This mix creates asymmetric responsiveness that balances the advantages and disadvantages of each method. Testing both methods can help determine which yields cleaner signals for the specific charts being traded.

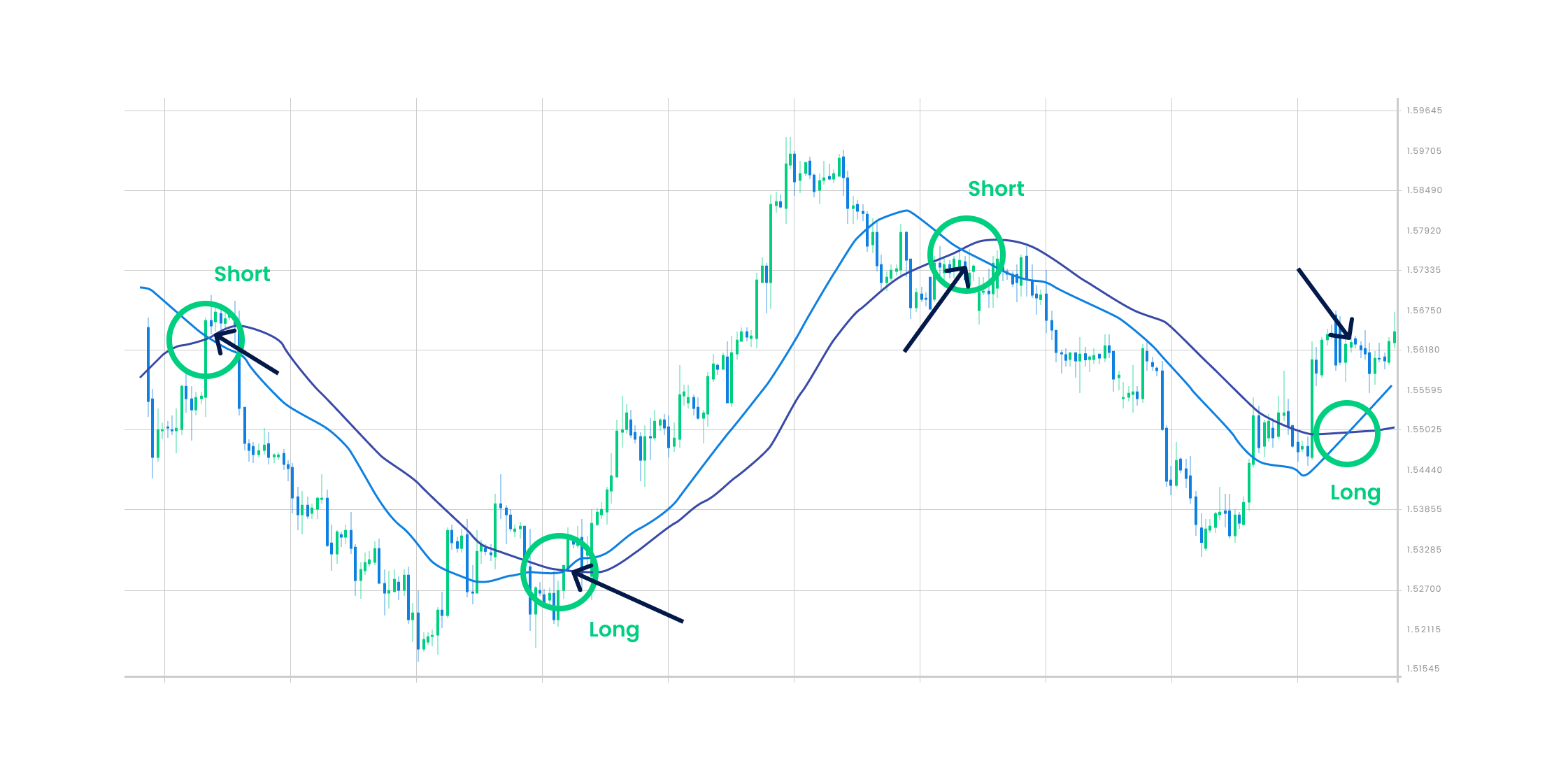

What signals indicate a bullish entry?

A bullish entry signal forms when a fast-moving average crosses above a slow-moving average. This crossover indicates that recent prices are rising faster than the historical average.

It's important to wait for the candle to close while the crossover is still visible, rather than entering in the middle of the candle. Price often declines before the period ends. Being patient helps avoid early entries into false breakouts that might reverse right away.

How do bearish entries work?

Bearish entries work the same way, but in reverse. When the fast average falls below the slow average, it indicates that downward momentum has taken control. Short sellers use this signal to start new positions, while traders who only buy view it as a sign to sell their current holdings.

The main point is to view the crossover as confirmation of current trends, not as a prediction of what will happen next. You are joining a trend that is already underway, rather than trying to guess when it will change.

How can volume analysis improve your strategy?

Raw crossover signals alone can lead to too many losing trades in choppy markets. By incorporating volume analysis, traders can better distinguish real breakouts from weak moves.

A bullish crossover with rising volume indicates real buying pressure, while a crossover with falling volume often precedes quick reversals. The Relative Strength Index (RSI) or MACD can also confirm whether momentum supports or opposes the crossover direction, helping identify potential traps.

Why are support and resistance levels important?

Support and resistance levels provide important context that simple moving averages may overlook. A bullish crossover at a major resistance zone carries higher reversal risk than one that breaks through in open space.

Also, looking at longer timeframes helps ensure trades align with the bigger trend rather than go against it. Even though these extra steps might reduce the number of signals, they significantly increase win rates by eliminating low-probability setups that appear tempting on their own.

How can market analysis streamline your process?

Many traders feel overwhelmed when manually tracking multiple indicators across multiple stocks. They also need to consider key factors such as earnings growth and valuation metrics.

Solutions like market analysis combine moving average crossover signals with AI-powered fundamental screening. This method helps show when technical breakouts align with stronger business fundamentals rather than relying solely on price patterns. This layered approach allows traders to distinguish between crossovers that are actionable and those that are likely to fail because they lack support from underlying value.

What should you do once your signal triggers?

Once your signal triggers and passes confirmation filters, enter the position with a stop-loss order placed below the recent swing low for longs or above the recent swing high for shorts. This approach sets your maximum loss before the trade starts, removing the emotional decision of when to cut losses.

Position size should reflect the distance to your stop, risking only 1-2% of your account on any single trade, regardless of how confident you feel.

How do exit strategies work?

Exit strategies are just as important as entry points. Some traders hold their positions until a crossover against them occurs, riding the entire trend until the system signals a change. Others set profit targets at key resistance levels or use trailing stops, which help preserve profits as prices rise.

A mechanical approach means traders must follow their exit rules, even when their instinct wants them to hold on longer or get out sooner. This consistency builds up over many trades, turning a small advantage into meaningful returns.

Why is trade documentation essential?

It's important to keep a record of every trade. You should note the entry date, exit date, crossover type, any filters you used, and the result. This journal can reveal patterns that backtests might miss.

For example, you might find that trading on Thursdays often leads to losses, or that morning signals make more profit than afternoon ones. After you complete 30-50 trades, you'll have enough data to identify which market conditions work well for your setup and which typically lead to losses.

When should you adjust your parameters?

Adjust parameters only after achieving statistically significant sample sizes, not just after three bad trades in a row. The temptation to change settings after every loss leads to constant optimization, which can erode any market advantage. Successful traders know that 40-50% of their crossover signals will fail.

Instead, they concentrate on whether their winners are much larger than their losers, which helps create positive expectancy. This math-driven perspective enables them to swap emotional responses for discipline in their processes.

When is the right moment to deploy the strategy?

Mechanical execution is important, but it only matters if the right moments are chosen to apply the strategy initially.

Tips for Successful Implementation of the Moving Average Crossover Strategy

Successful implementation requires moving beyond a basic setup into systematic testing, environmental assessment, and layered confirmation. It is essential to validate your chosen parameters against real market behavior before risking capital.

Understanding when market conditions favor your approach versus when they do not is crucial. Additionally, building safeguards can help protect your account during inevitable losing streaks. These elements transform a simple concept into a durable trading framework.

Why is testing configuration important?

Testing the configuration on historical price action shows whether the selected moving average periods capture profitable trends or create more noise than useful signals. It's important to use several years of data for the assets you plan to trade. During this analysis, check how often crossovers caused gains compared to losses.

Also, look at how long winning trades lasted on average and what the maximum drawdown would have been. This exercise shows whether the 10-day and 30-day combination worked due to a real advantage or simply by chance during a favorable market phase.

How can you automate analysis?

Use platforms such as MarketDash or Python libraries like pandas and backtrader to automate this analysis across multiple securities simultaneously. Test the same parameters across different stocks in your target sector to assess whether the results are consistent or vary significantly by ticker. If your setup earns a profit on three technology stocks but loses on seven others, you're seeing selection bias rather than a strong system. Step through the period lengths, comparing results for 9-21, 10-30, and 20-50 combinations to identify the balance between signal frequency and accuracy that matches your risk tolerance. Write everything down because your memory may not remember what really worked.

What market conditions favor crossover strategies?

Crossover strategies generate profits during strong directional moves and incur losses during range-bound trading. Before you start using your system, check if the overall market or a specific sector is trending or moving sideways.

See if the average directional index (adx) is above 25, which shows there is a strong trend, or below 20, which warns of flat trading conditions where crossovers can be unpredictable. Look at longer time frame charts to confirm the main pattern, because a bullish crossover on a daily chart doesn’t mean much if the weekly chart shows a tight range.

How do external events affect crossover performance?

Economic calendars and volatility indices give important context beyond just price movements. Major earnings seasons, Federal Reserve announcements, and geopolitical uncertainty often lead to longer price movements that crossovers can capture well.

On the other hand, summer doldrums or pre-holiday periods often lead to sideways price action, which can hurt crossover performance. Understanding these cycles can help traders avoid trading in adverse conditions, where patience is preferable to being active for no reason.

What tools can combine technical and fundamental analysis?

Most traders struggle to combine fundamental health checks with technical crossover signals. They often switch between earnings reports, balance sheets, and price charts.

Solutions such as market analysis combine moving average crossover alerts with AI-based fundamental screening and SWOT analysis. They show when technical breakouts align with growing revenue, higher margins, and favorable analyst upgrades. This layered approach helps traders distinguish between crossovers driven by underlying business momentum and those caused by temporary price movements, which are likely to reverse quickly.

How to manage risk and position sizing?

Position sizing based on stop-loss distance helps protect your account from big losses. First, calculate how much money you are willing to lose. Then, divide that amount by the distance between your entry price and stop-loss level. This number indicates how many shares to buy.

For example, if you risk $200 per trade and your stop is $2 below your entry price, you would buy a maximum of 100 shares no matter how confident you feel about the trade. This math-based method removes emotion from your decisions about how much to buy and prevents the costly mistake of putting too much money into a single trade.

Where should you set your stop-loss?

Set your stop-loss at a logical technical level rather than an arbitrary percentage. Put it below the recent swing low for long positions or above the recent swing high for shorts. This gives the trade room to breathe without letting losses get too large. Aim for a risk-to-reward ratio of at least 1:2.

For example, if you risk $200, aim for a $400 profit before you enter the trade. Once a trade starts to go in your favor, use trailing stops to secure your gains by raising your stop-loss as the price goes up. These mechanical rules help remove the confusion that happens when you have to decide in real time whether to hold or sell.

How does volume analysis enhance signals?

Raw crossovers trigger too frequently in choppy markets. However, adding volume analysis immediately improves signal quality.

A bullish crossover accompanied by volume 50% above the 20-day average suggests institutional participation rather than retail noise.

Conversely, when volume declines during a crossover, it often precedes quick reversals because the move lacks conviction.

It is crucial to check whether the price is breaking through a significant resistance level or oscillating within an established range. Context determines whether the crossover represents genuine momentum or a temporary fluctuation.

What role do momentum oscillators play?

Momentum oscillators such as RSI and MACD provide secondary confirmation, helping reduce premature entries. For example, if a bullish crossover happens while RSI is below 30, you might be catching a potential reversal from oversold conditions.

On the other hand, if this crossover occurs while RSI is over 70, you risk chasing a move that may already be exhausted. The MACD histogram's upward crossover confirms acceleration; however, narrower bars indicate fading momentum, even with the crossover signal.

These extra checks can cut signal frequency by 40-60%. In many cases, they can often double win rates by effectively filtering out low-probability setups.

Why is maintaining a trading journal essential?

Keep a trading journal that records the entry date, exit date, crossover type, any additional filters used, position size, and the outcome of each trade. After 30 trades, you will see patterns that backtests might miss. You may find that crossovers occurring in the first hour after the market opens deliver better results than those in the middle of the afternoon. You might also notice that trades made on Mondays do worse than those made on Wednesdays.

These behavioral insights only emerge through careful record-keeping that shows your actual trading habits compared to your planned strategies.

How can you track decision-making quality?

Track not just wins and losses but also the quality of your decision-making process. Did you follow your rules exactly, or did you make exceptions? Did you exit at your predetermined level, or did emotions override your plan? Reviewing these details monthly helps determine if losses come from a flawed strategy or inconsistent execution.

Many traders blame their systems; often, the real issue is their inability to stick to them. Keeping a journal provides objective evidence of where improvement is needed.

Why is it detrimental to adjust parameters frequently?

The urge to adjust moving average periods after three losing trades destroys more accounts than any market move. Every set of parameters faces tough times when nothing works. Changing settings during the process prevents traders from gathering sufficient data to determine whether the original setup was effective.

It is important to stick with the chosen periods for at least 50-100 trades before making changes. This gives time for statistical significance to show the difference between luck and skill.

How should you modify parameters?

When adjusting settings, change only one variable at a time to clearly see the impact on results. For example, if you switch from 10-30 day averages to 12-26 day averages, add an RSI filter, and adjust your stop-loss placement, you won't be able to determine which change affected the results.

This careful method of adjustment helps avoid endless tinkering, which can turn a potentially successful system into a constantly changing target that never gets a fair evaluation. It's important to accept that 40-50% of signals may fail and instead focus on whether the average winning trades are better than the average losing ones, so you can make positive returns over time.

Related Reading

- Ninjatrader Vs Thinkorswim

- Tradingview Alternative

- Tradovate Vs Ninjatrader

- Thinkorswim Vs Tradingview

- Trendspider Vs Tradingview

- Ninjatrader Vs Tradingview

- Tools Of Technical Analysis

- Stock Market Technical Indicators

- Tradestation Vs Thinkorswim

- Tradestation Vs Ninjatrader

Try our Market Analysis App for Free Today | Trusted by 1,000+ Investors

Real capital changes everything. The crossover that looked perfect on a backtest suddenly feels different when real money is at stake. This emotional gap is where most traders determine whether their system fits their personality.

MarketDash removes the guesswork by combining moving average crossover signals with AI-powered fundamental analysis. It shows when technical breakouts align with underlying business strength rather than just temporary price moves. You get clear entry signals supported by valuation context, earnings momentum, and side-by-side company comparisons. This helps you avoid overvalued traps and capitalize on opportunities before they rise sharply.

Start your free trial today and see why thousands of investors trust MarketDash to make their crossover strategy smarter, faster, and more confident. Stop getting overwhelmed by data. Start making profits from precision. market analysis