Motley Fool vs. Morningstar Comparison Guide

MarketDash Editorial Team

Author

Investors often ask, 'How do I predict stocks?' when comparing varied recommendations from trusted sources. Bold growth calls and dividend-focused strategies offer distinct perspectives, each emphasizing different valuation metrics and research insights. Weighing these factors provides clarity on which investment style best aligns with an individual portfolio.

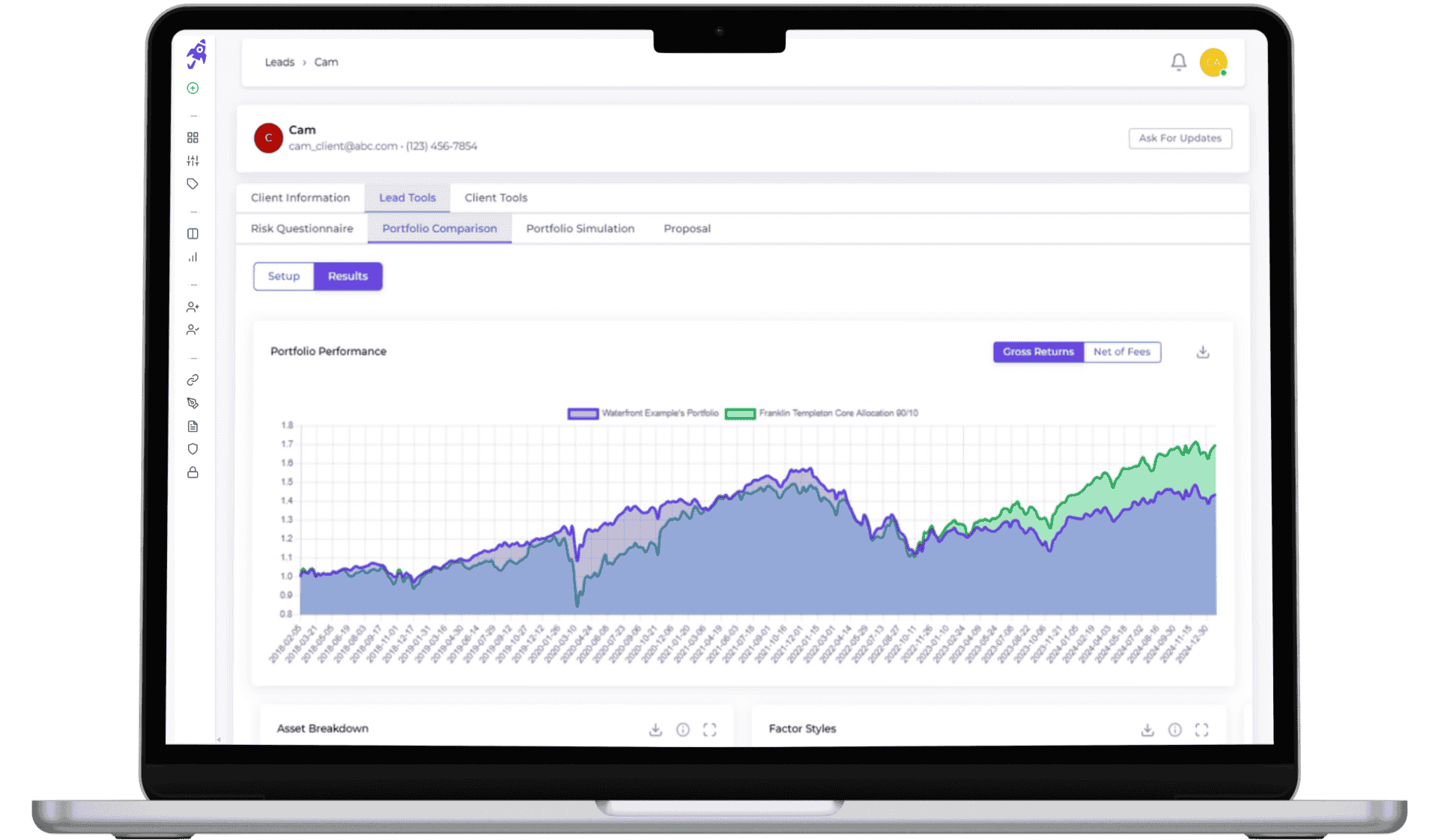

Consolidating analyst ratings, subscription insights, and historical data into a single view simplifies the evaluation process. MarketDash's market analysis tool aggregates essential financial information to streamline decision-making and enhance investment confidence.

Summary

- Motley Fool’s pick-driven model delivers long-term outperformance when conviction holds, citing roughly 500% returns over the last 20 years, but that same narrative focus can leave subscribers needing clearer follow-up during market shocks.

- Morningstar’s strength is breadth and standardization: it rates over 500,000 investment offerings and covers about 97% of the mutual fund market, making it ideal for cross-fund comparisons and audit-ready reporting.

- Professional investors routinely triangulate research to avoid single-source bias, with 90% of pros using data from at least three firms, underscoring how reliance on a single feed increases emotional trading and missed reassessments.

- Scale amplifies both signal and crowd effects, as seen with Motley Fool’s large audience (reported at over 700,000 paying members) and claims of roughly 4x S&P outperformance over a 17-year window, which can magnify liquidity and behavioral impacts around featured picks.

- Operational friction grows quickly as complexity rises, since simple workflows work for portfolios with fewer than a dozen positions, but manual reconciliation across multiple accounts and tax lots becomes a major time sink beyond that point.

- A practical 30-day pilot that measures four metrics and requires a yes/no/hold decision within 48 hours of each alert is an effective way to test whether a research provider truly shortens your time-to-action.

- MarketDash addresses this by consolidating analyst ratings, valuation data, subscription insights, and historical performance into market analyses that highlight actionable signals and shorten decision cycles.

What is Motley Fool, and How Does It Work?

Motley Fool is a subscription-based financial publisher. They mix analyst research, educational content, and community features to suggest long-term stock ideas and recurring monthly picks.

Their model focuses on human-led fundamental research, clear buy-and-hold guidance, and tools that help members track recommendations along with their personal portfolios. For those making informed decisions, market analysis can provide valuable insights into stock performance.

So, how do they choose stocks?

When analysts evaluate opportunities, they build trust based on leadership quality, strong competitive advantages, and consistent growth trajectories. They monitor changes, avoiding the mindset that a pick is a one-time thing. This careful method supports their public performance record.

According to Wall Street Survivor, "Motley Fool's Stock Advisor service has a track record of 500% returns over the last 20 years." (2026). This strategy demonstrates sustained long-term outperformance relative to broad benchmarks over decades.

What do members actually receive?

Most subscriptions bundle a steady stream of monthly stock picks, model portfolios, articles, and a dashboard for performance comparison and alerts. The community scale greatly affects the experience. For example, Motley Fool reports over 1 million members, which creates active forums, analyst Q&A sessions, and a variety of member-shared real-money portfolios that newcomers can study.

Where do common gaps appear?

This challenge shows up in many advisory services, not just here. Subscribers often receive a clear buy recommendation initially, but then they struggle to follow through when markets become unstable.

After working with investors who used recommendation newsletters, I noticed a pattern: frustration increases when they want continuous signals and explanations, not just a fixed pick sheet. This uncertainty can lead people to act emotionally in the worst moments.

Why Some Users Question Responsiveness?

The familiar approach is to treat monthly picks as enduring endorsements. This strategy holds until a sector rotation or macroeconomic shock requires a faster reassessment.

The hidden cost becomes predictable: members either abandon a good position during a drawdown or cling to a stale thesis because they lack timely, actionable guidance that links news to key portfolio actions.

How can platforms reduce noise and speed decisions?

Most investors rely on headline picks because they need an easy way to make decisions. However, this simplicity can become costly when used frequently. Solutions like MarketDash offer an alternative by combining human expert curation with AI.

They create four focused reports, weekly opportunity alerts, and short, action-ready recommendations that turn research into clear next steps. Teams find that this method reduces time spent searching for signals and replaces unclear advice with measurable, repeatable decision rules.

What metaphor captures this situation?

A quick metaphor is that Motley Fool often offers a well-researched playbook and a locker-room pep talk. However, members sometimes need in-game coaching to know when to change plays. This is what newer platforms try to provide.

What is the interesting tension for investors?

The tension between a strong long-term record and the need for real-time, adaptive guidance makes the investment landscape particularly intriguing for investors.

What is the real contrast coming next?

The real contrast is now approaching. This is changing the argument in a way that most people do not expect.

Related Reading

- How to Predict Stocks

- What is Top-Down Analysis

- Fundamental vs Technical Analysis

- Portfolio Risk Assessment

- Fundamental Stock Analysis

- Equity Analysis

- How to Identify Undervalued Stocks

- Financial Statement Review

What is Morningstar, and How Does It Work?

Morningstar is a large, organized research firm that changes company filings, market feeds, and analyst reviews into ratings, fair value estimates, and portfolio diagnostics that investors can use. Its output is a clear guide for decisions without replacing personal judgment.

For those interested in expanding their insights, utilizing market analysis tools can enhance their investment strategy.

How extensive is Morningstar’s coverage?

Morningstar rates over 500,000 investment offerings globally (Morningstar, 2023), which explains why its screeners and terminals can find both small ETFs and popular mutual funds in the same search. Morningstar's ratings cover 97% of the mutual fund market (Morningstar, 2023), which makes its star system especially helpful when you need a quick comparison between funds rather than a deep analysis.

How do they gather data and convert it into ratings?

They take in filings, exchanges, custodial feeds, and third-party datasets. Then, they process that information using quantitative models and analyst overlays. This method creates outputs such as star ratings, moat assessments, and fair value estimates. The quantitative layer standardizes returns, volatility, and fees.

Meanwhile, the qualitative layer accounts for factors such as strategy drift, management changes, and structural risk. This combination produces useful signals. However, it can also lead to failures: models often assume conditions that may change unexpectedly, and analysts' decisions can be slow to respond to rapid shifts in market sentiment.

When do Morningstar outputs help you, and when do they mislead?

Morningstar’s tools are most helpful when consistency across a large universe is needed. This is especially true when comparing fees or historical risk profiles across funds. However, they can mislead investors if they treat a single rating as a decision rule, particularly during sharp drop events.

After conducting post-trade reviews with clients over a 12-month period, a clear pattern emerged: investors who relied solely on fair value estimates were often blindsided when a rapid selloff outpaced the model. Many regretted not having explicit stop or reassessment rules in place. This frustration is important because rational ratings do not remove emotional risk.

How should you combine Morningstar with personal objectives?

If your goal is a steady income, pair fund ratings with cash flow metrics and payout history. If your aim is long-term growth, focus on forward earnings and reinvestment profiles instead of trailing yield.

When helping a retirement client rebalance, our practical rule was simple: use Morningstar screens to narrow the candidate set. Then apply two custom checks, timeframe alignment and overlap concentration, before committing capital. This approach helps reduce the common tradeoff that investors face between initial yield and compounding growth.

What breaks as scale and complexity increase?

As portfolios, accounts, or tax situations grow, manually checking and relying on fixed ratings can take significant time. Most investors use star ratings to simplify and reduce cognitive load. However, this shortcut can lead to hidden costs, such as redundant investments, outdated ideas, and slow responses to new information.

Platforms like MarketDash help address this problem by providing curated, outcome-focused reports and AI-assisted monitoring. This transforms a general rating into a clear checklist of immediate actions, reducing research time and ensuring decisions are accurate and up to date.

How do institutions and advisors actually use Morningstar data?

Advisors often integrate Morningstar feeds into client reports and model portfolios. They use the firm's thorough coverage and standardized metrics to explain their choices and audit fund selection. Institutions also use this data for benchmarking and compliance, as consistent, clear inputs help reduce disagreements over performance attribution. Serious investors, however, view Morningstar as an important information source rather than a replacement for a personalized investment strategy.

What is the risk of power without guardrails?

Morningstar is powerful, but power without guardrails can lead to regrets. What happens next shows the clearest difference between wide ratings and outcome-first research.

Motley Fool vs. Morningstar

The main difference is how each turns research into useful insights. Motley Fool provides strong recommendations with a small number of high-quality picks that investors can act on quickly.

In contrast, Morningstar provides broad, standardized signals that users must interpret for their specific trades. This shows that one platform prioritizes quick decisions based on stories, while the other prioritizes systematic comparisons and accountability.

Motley Fool and Morningstar are both useful resources for individual investors managing their portfolios, but they cater to different preferences by focusing on different methods and data types. User reviews on Trustpilot indicate that Motley Fool is effective at providing clear stock recommendations for those seeking guidance. Meanwhile, Morningstar is known for its extensive analytical resources that allow users to perform their own evaluations.

This comparison highlights their shared goal of supporting self-directed investing while noting differences in costs, tools, promotional approaches, investment philosophies, and selection methods. These factors help determine which platform is the better fit for personal needs.

What are the pricing differences?

When evaluating financial advisory platforms, affordability is critical, regardless of your financial situation. This ensures you aren't spending too much on things you don't really need. Based on Trustpilot feedback, many users appreciate that both services offer competitive rates, but they note differences in trial options and discounts that affect their perceived value.

Motley Fool's annual fee is $199, but it often drops to $99 for new users through special offers. However, some reviewers note that there is no free trial, which may be a downside for cautious subscribers.

On the other hand, Morningstar charges $34.95 each month or $249 each year. They also offer savings by committing to a longer term and a seven-day free trial, which reviews say helps users decide whether the service is right for them before they pay in full.

What tools do they offer for analysis?

The availability of research and evaluation tools is an important difference between these platforms. It affects how users find and evaluate possible investments. Trustpilot reviews often note that The Motley Fool prioritizes simplicity over advanced tools. On the other hand, Morningstar is praised for its robust set of tools that support deeper analysis.

The Motley Fool primarily serves as a recommendation service, providing monthly recommendations without built-in screeners, historical testing, or options for personal selection. Reviewers say that this method works well for those who like expert-curated lists to steadily build wealth.

In contrast, Morningstar requires more effort from users but offers more detailed breakdowns, including historical performance and valuation forecasts. This helps subscribers make informed decisions by using tools that analyze fundamentals and predict potential growth.

How do their marketing approaches differ?

Promotional strategies can significantly affect user satisfaction, especially when constant sales pitches feel intrusive. Insights from Trustpilot indicate that subscribers often note that Motley Fool's aggressive upselling differs from Morningstar's more moderate approach. This difference can affect the choices of people who are sensitive to email overload.

After joining Motley Fool, members get frequent messages promoting extra offerings at discounted prices. While some see this as a savings benefit, others find it bothersome. However, it is easy to opt out, as mentioned in several reviews.

On the other hand, Morningstar offers fewer add-on products and sends little promotional content. Reviewers like this approach because it keeps the experience cleaner without feeling pressured to upgrade.

What are their investment strategies?

It's important to align a service's methods with your investment principles to succeed in the long term. Trustpilot users note that Motley Fool's clear, long-term focus attracts patient investors, while Morningstar's complex analysis appeals to those who prefer data over simple advice.

Motley Fool takes a careful approach, focusing on well-established companies with strong market positions, competitive advantages, and sound management for steady growth. They suggest holding value stocks for at least five years.

On the other hand, Morningstar combines numbers and interpretations for over 600,000 assets, including funds and exchange-traded products. They offer curated lists and insights without requiring purchases, allowing users to build their own portfolios using the information provided.

How do they approach stock picking?

Each platform’s approach to finding and recommending stocks makes a significant difference in how it helps build a portfolio. Based on Trustpilot experiences, Motley Fool's direct picks are liked for their ease of use, while Morningstar's helpful approach is valued for encouraging investor autonomy.

Motley Fool provides ready-to-use selections through regular newsletters. These newsletters include essential core holdings and bi-weekly top picks from the founders, along with extra timely recommendations. Reviewers mention that this method makes diversification easier for subscribers.

On the other hand, Morningstar does not make specific picks; instead, it offers detailed analyses and a portfolio review tool that assesses allocation, diversification, and expenses. This helps users refine their strategies with actionable feedback on optimization.

That last friction is where most choices quietly fail. What actions are taken next will determine if the research partner helps drive effective action or just keeps one busy.

Related Reading

- Dividend Coverage Ratio

- What Are the Key Financial Ratios

- Fundamental Value

- Fundamental Stock Data

- Best Fundamental Analysis Tools

- Investor Preferences Tools

- Stock Analysis Apps

- Types of Fundamental Analysis

- Balance Sheet KPIs

Which Investment Research Firm Should You Choose?

Choose the firm that fits your specific decision-making needs. If you want quick, confident buys with little daily hassle, pick curated pick services. For easy comparisons across funds with many holdings, go for standardized research.

If you want both speed and depth, consider a hybrid approach that combines daily quantitative screening with focused analyst reports. The right choice will depend on how often you trade, how many accounts you manage, and how much hassle you can handle when markets change quickly.

Choosing the right investment research platform can significantly impact your portfolio’s long-term performance. Firms like Motley Fool and Morningstar have been leaders in this field for many years, but they serve very different types of investors.

Motley Fool provides curated growth-stock recommendations, while Morningstar offers high-quality data and fund analysis. Both platforms are strong in what they do, but many investors now want a solution that combines the best of both, without outdated delivery or high ongoing costs.

Who should choose Motley Fool?

The Motley Fool built its reputation on Stock Advisor, a service that sends members two carefully vetted growth-stock recommendations every month, along with a list of essential stocks every serious investor should consider owning. Since it started, its main recommendations have returned over 800%, compared with the S&P 500’s roughly 150% over the same period (as of late 2025). This makes it one of the most consistent stock-picking services that are profitable for retail investors.

What separates Motley Fool from plain data platforms is its focus on storytelling and conviction. Each pick includes a brief explanation of why the company can grow for many years, not just a few quarters.

This method works particularly well for busy professionals who want to invest new money each month without spending hours researching. If you’re the kind of investor who likes to buy five to ten strong picks and hold them for more than five years, Motley Fool remains the gold standard.

Who should choose Morningstar?

Morningstar earned its great reputation from careful, independent analysis of mutual funds and ETFs. However, its Premium platform, now called Morningstar Investor, also looks at thousands of individual stocks. It provides fair value estimates, economic moat ratings, and uncertainty scores. Professional advisors and skilled DIY investors use these tools every day because the data is clear, consistent, and doesn't have promotional bias.

The real strength is in the portfolio X-ray and screening tools. These tools let users see style-box exposure, sector weightings, and fee-adjusted performance for every holding in just seconds.

Whether you are managing a mix of index funds, active funds, and individual stocks, or you want to find out if a fund is likely to do better than its category in the next market cycle, Morningstar offers unmatched detail. It’s the closest thing retail investors have to institutional research terminals.

What limitation do both services share in 2026?

Both platforms still rely heavily on traditional analyst teams to produce weekly or monthly reports. In a market increasingly influenced by real-time events such as earnings surprises, insider transactions, and shifting sentiment, waiting for the next scheduled update can lead to missing the best opportunities to profit. Neither service consistently evaluates every important stock daily using a numerical method, leaving investors to assemble insights on their own.

What is MarketDash, and why is it a better alternative?

MarketDash has quickly become the preferred choice for investors who don’t want to compromise on great stock picks and institutional-grade data. It combines AI-driven daily stock ratings with expert fundamental analysis to deliver actionable insights faster and more consistently than legacy services.

Every trading day, MarketDash’s algorithm checks thousands of U.S. stocks based on growth, value, quality, and momentum factors. Then it ranks these stocks using a proprietary Dash Score out of 100. Stocks scoring 90+ have historically outperformed the market over the next 6 to 24 months.

Members get a selected ‘Top 10 Dash Scores’ list each week, along with four detailed reports: fundamental breakdown, technical setup, peer comparison, and valuation model on each high-scoring stock. This method provides ready-made picks, similar to what Motley Fool is known for, but updated daily rather than monthly, while still delivering the thorough financial modeling that Morningstar users expect.

Why is MarketDash the clear upgrade in 2026?

The biggest advantage is speed and coverage. While The Motley Fool recommends reviewing about 24 stocks per year and Morningstar’s analysts can cover only a small portion of the market with detailed reports, MarketDash reviews all available stocks every night.

It highlights only the stocks that meet strict institutional-quality criteria. Users often find tomorrow’s winners months before regular analysts write their first report.

The platform also eliminates the analysis paralysis that often accompanies complex data services. Instead of navigating hundreds of metrics, MarketDash provides a simple one-page dashboard. This dashboard quickly indicates whether a stock is undervalued relative to its historical prices, is outperforming competitors, and is improving across key metrics. It also shows exactly how much potential gain the model sees at current prices.

Investors say it feels like having a full-time senior analyst and a quant team working just for them, 24/7.

Are you ready to invest smarter in 2026?

If you’re tired of waiting for monthly picks or searching through tons of data to find the next great chance, MarketDash gives you a complete modern solution. With daily AI-powered rankings, weekly expert deep dives, and a proven scoring system that often outperforms the market, everything is available in one easy-to-use interface.

Join thousands of investors who have already switched to MarketDash and see why it’s quickly taking the place of both Motley Fool and Morningstar portfolios.

Start your free trial today and find out why thousands of investors rely on MarketDash to make their stock research easier!

Try our Market Analysis App for Free Today | Trusted by 1,000+ Investors

Most investors eventually discover that too much data and too many opinions can make it hard to make decisions. The smart choice is to run a quick, practical test rather than get lost in more theory. We suggest you try platforms like MarketDash on your own accounts and timeline. This way, you can see whether a precision-focused workflow helps you make decisions faster and leads to smoother, more reliable execution.

Related Reading

- Best Portfolio Analysis Software

- Finviz Alternatives

- Stock Rover vs Seeking Alpha

- Finviz vs Tradingview

- Seeking Alpha vs Morningstar

- Seeking Alpha Alternatives

- Seeking Alpha vs Tipranks

- Simply Wall St vs Seeking Alpha